|

|

|

|

|

Centrica To Sell North American Franchisee Home Services Business Clockwork

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

Centrica today reported preliminary results for the year 2018, and in doing so announced that it is targeting divestments of non-core positions totalling £500m

As part of that £500m, Centrica plc announced that it will sell Clockwork, Inc., and certain of its affiliates (Clockwork) in North America to Authority Brands, a home services franchise platform backed by funds advised by Apax Partners for $300 million. Clockwork consists of over 725 franchise territories, and 10 company-owned stores, and brands including One Hour Heating & Air Conditioning, Benjamin Franklin Plumbing, Mister Sparky electric, BuyMax, Success Academy and SuccessWare 21.

Centrica called the sale of Clockwork, "in line with Centrica's intention to drive channel and brand rationalisation across the Group, with a continued focus on the efficiency and effectiveness of those channels and Centrica's ability to offer a range of energy and services propositions through them."

"The Company retains a material home services business in North America and will continue to target growth in its home protection plan and home warranty offers sold under its own brands," Centrica said

Direct Energy stated, "Centrica's consumer strategy has evolved, with an increased focus on developing ongoing customer relationships through home protection plans and home warranty offers, and on developing its own home services brands and driving simplification and focus in the scope of services we deliver to customers. The sale price represents an attractive multiple of Clockwork's 2018 EBITDA."

"Direct Energy will focus on building ongoing relationships with our customers and continue to deliver growth through both energy and a broader network of home service providers, as well as expanding our home protection plans and home warranty offers. The decision for this sale reflects our goals to focus and simplify our channels to customers and to own our own brands," said Bruce Stewart, president of Direct Energy Home North America.

"Centrica acquired Clockwork in 2010 for $183 million and the sale price represents an attractive multiple of Clockwork's 2018 EBITDA," the company said

The net assets of the entities to be disposed of in the Clockwork transaction, plus the carrying amount of associated intangibles and estimated allocation of goodwill, result in approximately £117 million (US$150 million) of assets to be divested in exchange for consideration of approximately £234 million (US$300 million). The disposal may trigger a potential impairment of a shared IT system of up to £66 million (US$85 million). The goodwill allocation exercise, impairment review and recycling of any foreign exchange balances from reserves will be finalized prior to the expected transaction completion date of April 2019, Centrica said

Iain Conn, Group Chief Executive, Centrica plc, said, "The disposal of the Clockwork portfolio is aligned with our intention to drive channel and brand simplification across the Group focusing on our owned channels and is the first part of our £500 million divestment programme of non-core assets we announced today alongside our 2018 Preliminary Results. We will continue to drive capital discipline and returns across our portfolio."

Mark Hodges, Executive Director and Chief Executive, Centrica Consumer, said, "Clockwork has been a good business for Centrica since its acquisition in 2010. However, with Centrica's focus on building ongoing customer relationships, it makes sense now for us to sell the business and focus on continuing to deliver growth through protection plan and home warranty offers. I am pleased we have found a good home in Authority Brands and wish the Clockwork business and its franchisees the best for the future."

"The remainder of the divestment programme will be delivered through the disposal of further non-core assets over the balance of year, including possible capital recycling in DE&P [Distributed Energy & Power] and E&P [Exploration & Production]," Centrica said

2018 Results

Centrica reported that its North America Home (energy supply and service combined) segment's adjusted operating profit for the year 2018 was up 11% in local currency despite less favorable weather conditions for energy supply, reflecting cost efficiencies, improved services performance and the full year impact of its exit from the loss-making residential solar business in H2 2017.

Specifically, North America Home adjusted operating profit for 2018 was $165 million in local currency, up from $148 million a year ago. "This was largely due to reduced losses in the services business reflecting the closure of the loss-making residential solar business, growth in services and cost efficiencies."

North America Home Energy Supply adjusted operating profit was $181 million for the year 2018, down 4% versus $189 million a year ago, with the impact of efficiencies largely offsetting the impact of lower customer accounts, a changed customer mix with more fixed price contracts and the impact of less favourable weather conditions

Gross revenue for North America Home Energy Supply for the year 2018 was £2.079 billion, versus £2.246 billion a year ago

Centrica's North America Home energy supply accounts stood at 2,545,000 as of December 31, 2018, up from 2,537,000 as of June 30, 2018, and compared to 2,570,000 a year ago.

The net growth of 8,000 customers from June 30, 2018 in the North America Home energy supply segment compares to a net loss of 33,000 customer accounts from December 31, 2017 to June 30, 2018

A breakdown by region is below:

Regarding North American Home energy supply customers, Centrica said, "Our more sophisticated use of data analytics in North America is allowing us to focus on acquiring and retaining the most valuable customer segments through cost effective channels and we delivered a significant increase in sales to higher usage customers at a lower cost to acquire."

For North American Home energy supply, Centrica reported, "lower churn rates across all regions and a migration of customers from variable to fixed tariffs."

Regarding North American Home energy supply, Centrica said, "Accounts in Texas fell by 4%, however our use of data analytics has allowed us to focus our acquisition and retention on customer segments with the highest estimated lifetime values. As a result, we delivered a significant increase in sales to higher value customers at a lower cost to acquire, and improved retention of more valuable customers on fixed price contracts."

Regarding North American Home energy supply, Centrica said, "While regulatory scrutiny and competitive pressures in certain US North East markets remain a challenge, we won some profitable community aggregations and auctions, while account losses in Canada slowed as we rebuilt sales channels following our exit from door-to-door sales activity in 2017."

North American Home services customers were 892,000 as of December 31, 2018, versus 871,000 as of June 30, 2018, with further growth in Direct Energy paid protection plans. Further account growth and efficiencies are targeted in 2019, the company said

Centrica said that its North America C&I supply business (labeled "North America Business") segment, "faced continued challenging trading conditions in 2018, with continued high levels of competitive intensity and the expected squeeze on retail power margins resulting from the timing effect of power capacity charges in the US North East, which were higher in 2018 but are expected to be lower in subsequent years."

Centrica said that, "recovery in North America Business was slower than expected."

The North America C&I supply business, "also experienced unfavourable weather conditions, which impacted power gross margin," Centrica said

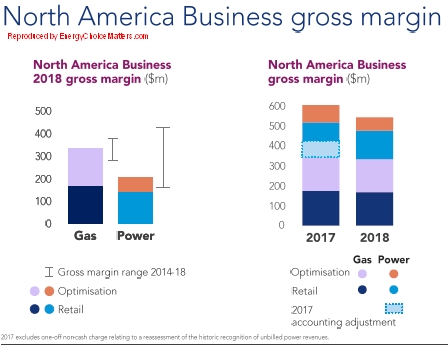

For the North America C&I supply business, Centrica said, "As a result, although power adjusted gross margin increased by 10% in local currency to $209m, when excluding the impact of an $82m one-off non-cash charge in 2017 relating to the historic recognition of unbilled power revenues, underlying power adjusted gross margin fell by 23%. We currently expect power adjusted gross margin to improve in 2019, in part reflecting the lower power capacity charges in future periods, and total net margin under contract for 2019 at the end of 2018 was higher than the net margin under contract for 2018 at the end of 2017. Total gas adjusted gross margin was down 3% to $334m in local currency compared to 2017, with strong gas optimisation performance during a particularly cold January in the US North East offset by the impact of unfavourable weather conditions and two pipeline outages which limited optimisation opportunities in the second half of the year."

For the North America C&I supply business, adjusted reported operating profit increased 25% in 2018 to $109 million, up from $87 million a year ago

However, the year-ago operating profit included a one-off non-cash charge. Excluding this year-ago one-off charge, North America C&I supply business adjusted operating profit fell by 39%, reflecting the unfavorable weather conditions and, "the squeeze on retail power margins," Centrica said

Discussing the North America C&I supply business decline in operating profit when excluding the year-ago one-off charge, Centrica said, "This reflected competitive market conditions and the expected squeeze on retail power net margins on multi-year fixed price contracts signed in earlier periods due to the timing effect of capacity charges in the US North East. However, we are seeing a return towards more historically normal unit net margins in future years, with 2019 margin under contract at the end of 2018 ahead of where 2018 margin under contract was at the same time last year."

For the North America C&I supply business, Centrica said, "We remain focused on driving improvements in profit and returns and continuing to deliver high levels of customer satisfaction in North America Business and during the year implemented changes in our sales channel mix and products. Total customer account holdings were down 65,000 during 2018, reflecting our exit from the higher-cost door-to-door and third-party telesales sales channels. These are being replaced by lower-cost digital channels and during the year we also enhanced the web enrolment experience and our customer targeting model."

For the North America C&I supply business, Centrica said, "In addition, our recently launched rewards programme, which is targeted at higher value SME customers, is helping enhance customer retention and customer lifetime value. During 2018, we launched our Fixed Energy Plus offer, which is targeted at high consuming businesses. It gives customers access to real time usage through our PowerRadar application and alerts them when system load is peaking, allowing them to lower capacity charges in their energy bills by proactively reducing consumption. Since its launch we have continued to improve the offer to fit the needs of our customers, acting on feedback from brokers and customers. We also expanded our Energy Portfolio platform which gives customers direct access to our energy expertise while providing dynamic energy procurement options. North America Business continues to work closely with the Distributed Energy & Power business and is an important sales channel for distributed energy products."

For the North America C&I supply business, Centrica said, "We continue to focus on building our strong gas position in the US North East, in addition to expanding our offer into new geographies to diversify risk across the portfolio, and during the year we completed three small bolt-on acquisitions. In February, we acquired New Jersey Resources’ retail natural gas business, which supplies around 45bcf of gas per year to customers in the US North East and Mid-Atlantic. In July, we acquired a portion of BP’s US retail marketing operation, which supplies around 100bcf of gas per year to customers in Indiana, Kentucky, Tennessee and Ohio. In December, we completed the acquisition of Source Power & Gas, a retail energy provider serving 4,000 customers with an approximate annual load of 6.5TWh in Texas, Illinois, Ohio, New Jersey, Delaware, Maryland, Pennsylvania and the District of Columbia. Including the impact of these acquisitions, total gas consumption was up 19% compared to 2017, with power consumption flat."

All three acquisitions (and purchase prices) had been previously reported by EnergyChoiceMatters.com, with the details further noted

On 28 February 2018 Centrica acquired NJR Retail Services Company for cash consideration of US$24 million (£17 million) of which US$13 million (£10 million) was deferred. The provisional fair value of assets and liabilities acquired was US$18 million (£13 million) resulting in goodwill of US$6 million (£4 million) (prior story here)

On 1 July 2018 Centrica acquired North American mid-continent retail operations from BP Canada Energy Marketing Corporation constituting a business for cash consideration of US$39 million (£31 million). The provisional fair value of assets and liabilities acquired was US$18 million (£15 million) resulting in goodwill of US$21 million (£16 million) (prior story here)

On 31 December 2018, Centrica acquired certain retail power operations from Source Power & Gas Business LLC. As this transaction was accounted for as an asset acquisition, cash consideration of US$26 million (£21 million) was allocated to the assets acquired (prior story here)

Regarding the North America C&I supply business, Centrica said, "We also increased our market share organically in a number of regions, including Canada, Texas and California."

The North America C&I supply business had 505,000 customers as of December 31, 2018, versus 538,000 as of June 30, 2018, and 570,000 a year ago

North America C&I supply business electric volumes were 84,255 GWh for 2018, up from 83,980 a year ago. North America C&I supply business natural gas volumes were 7,064 mmth for 2018, up from 5,930 mmth a year ago.

North America C&I supply business gross revenue was £8.820 billion for 2018, versus £8.158 billion a year ago

A chart from Centrica showing Gross margin details for the North America Business (C&I) segment is below:

In its Connected Home segment, Centrica said that the number of Connected Home subscriptions more than doubled during the year to 194,000.

During the year, the cumulative number of Connected Home customers (including non-subscriptions) increased by 444,000 and stood at 1.34 million at the end of the year. Centrica also sold 1.2 million connected home products in the year, and has now sold nearly 3 million products in total.

Connected Home adjusted gross margin increased by 63% to £13m for 2018, with the average adjusted gross margin percentage remaining at 19%, while the Connected Home adjusted operating loss of £85m for 2018 was 11% lower than 2017 which also includes the impact of lower adjusted operating costs.

ADVERTISEMENT Copyright 2010-16 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Announces Target Of £500m In Non-Core Divestments

Sees North American Residential Customer Growth (But Net Loss In Texas)

North American C&I Supply Business Improving, But Recovery Slower Than Expected With Continued "Squeeze[d]" Margins

February 20, 2019

Email This Story

Copyright 2010-19 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

Centrica

North America Home Energy Supply

Customers (In Thousands)

As of 12/31/17 6/30/18 12/31/18

Texas 654 640 628

Northeast 983 975 1,010

Canada 933 922 907

Total 2,570 2,537 2,545

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Chief Operating Officer -- Retail Supplier

• NEW! -- Retail Energy Channel Manager -- Retail Supplier

• NEW! -- Energy Sales Broker

• Business Development Manager -- Retail Supplier -- Houston

• Business Development Manager

|

|

|

|