|

|

|

|

|

ERCOT Says Workgroup "Re-Examining" Surety Bonds As Financial Security Based On Summer 2019

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

ERCOT, the IMM, and Staff of the Texas PUC filed presentations reviewing the summer 2019 market performance in advance of an October 11 workshop

ERCOT filed a presentation which includes the following observations, among others:

• There were many days with tight conditions, and an Energy Emergency Alert (EEA) Level 1 was declared twice. Emergency Response Service (ERS) deployments prevented the need for EEA2.

• Peak demand day saw higher Intermittent Renewable Resource (IRR) production. As a result, it was not one of the highest-priced days, and there was no EEA.

• Tightest conditions frequently occurred earlier than time of peak demand.

• Resource performance continues to outpace historical patterns.

• Distributed generation increased net output by an estimated 150-200 MW during Aug. 12-16 peaks.

• Overall, the market outcomes supported reliability needs.

• Even with significant pricing events, there were no mass transitions.

ERCOT further said that there was only one default of an entity with no load or generation (occurred in September) (see story here)

ERCOT said there was one "near-miss" where an initial short-payment was later resolved. Although ERCOT did not identify the entity to which it was referring in its presentation, Axon Power and Gas LLC had initially failed to make payment on a Settlement Invoice at the end of August, but ERCOT later received full payment for such invoice, as previously reported by EnergyChoiceMatters.com

ERCOT further said that, "The Credit Work Group is evaluating this event and re-examining surety bonds as financial security."

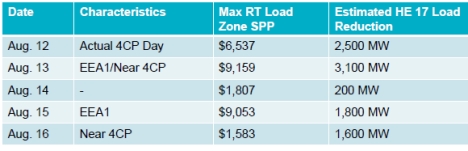

ERCOT also provided preliminary load reduction observations for the peak week

ERCOT noted that the information needed to accurately evaluate demand response during 2019 is not yet available. Customer-level data is needed to evaluate the occurrence and load reductions in response to various factors. Data and results for summer are expected to be available by December 2019.

The reductions shown below are estimates of the total of all load reduction (including ERS, 4CP and for high prices), calculated using regression baseline estimates of ERCOT total load. ERCOT said that load reductions are small relative to the total load, so the accuracy of the load reduction estimates is relatively low.

ERCOT's preliminary estimates of load reductions are:

ERCOT listed future opportunities as follows:

• Filed NOGRR to clearly allow operators to deploy smaller amounts of RRS at a time.

• Use event data to inform a review of ERS assumptions used for the

reliability deployment price adder, such as the 10-hour recall period.

• Continue to focus on Real-Time Co-optimization, while assessing

whether any improvements can be made to the existing processes

in the interim. ERCOT said that RTC would have increased reliability and economic efficiency by:

--- Improving the ability of SCED to dispatch NFRC ahead of frequency

responsive capacity to maintain higher levels of PRC and reduce the

duration of the two EEA1 events on Aug. 13 and 15.

--- Allowing more efficient dispatch of lower-cost capacity that was reserved

behind the High Ancillary Service Limit (HASL) and procurement of AS from

higher-generating cost capacity during tight conditions.

--- Reducing the number of ramp-constrained dispatch conditions.

• Consider changes to OCN issuance procedures.

• Discuss switchable generation scenarios and possible market

rule changes.

• Continue to work with gas generators and gas companies on

coordinated communication processes.

• Work with fossil fuel generators on gathering appropriate

emission limitation data to assist in enforcement discretion

requests.

• Complete summer demand response study by December

2019.

IMM Observations

The ERCOT Independent Market Monitor filed a presentation with the following observations, among others:

• EEA conditions were not on the highest load days

• Net Load (Load – Wind) is a better predictor of high prices

• Highest prices are no longer associated with highest loads

• Larger adders contribute to higher 2019 prices

• ORDC Adder is a more frequent contributor to price

• Peaker net margin is the highest ever (an estimated $134,000/MW-year though September)

• ORDC Change has resulted in higher PNM ($26 - $30K increase)

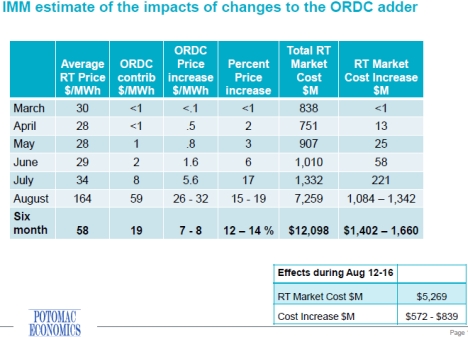

The IMM also estimated the impacts from changes to the recent ORDC adder. In January 2019, the PUC had directed ERCOT to implement a .25 standard deviation shift in the loss of load probability (LOLP) calculation using a single blended ORDC curve as soon as practicable with a second step of .25 in the spring of 2020. ERCOT implemented a single curve and first step of the ORDC changes on March 1, 2019.

Given the uncertainty of the magnitude of the ‘uncapped’ RDP adder, the IMM has developed a range of ORDC effects for periods when real-time prices were capped.

"The effects of the move to a single ORDC curve are larger than the effects

of the .25 standard deviation change. The impacts of an additional .25

standard deviation change are expected to be smaller than what has

occurred," the IMM said

The IMM's estimates are below:

The IMM listed the following areas for continued review, analysis and discussion

• Should the amount spent for ERS be adjusted?

• Should the RDP-related assumptions for ERS deployments

be adjusted?

• Are there short term (pre-RTC) adjustments to be made to

improve access to lower quality reserves (NFRC) for energy

while maintaining frequency responsive capacity as

reserves?

• Is there a risk of consuming ‘too much’ Reg-Up when the

Power Balance Penalty Curve sets LMP for ‘lengthy’

durations? If so, should the PBPC be adjusted?

Complaints Against REPs

Staff of the Texas PUC filed a presentation detailing the number of complaints against REPs received by the PUC's customer Protection Division (CPD)

Total complaints against REPs were 1,964 for the months of June through September 2019, as follows:

In August 2019, "billing" complaints against REPs were 428, or 66% of complaints against REPs

In September 2019, "billing" complaints against REPs were 454, or 65% of complaints against REPs

"Complaints from customers utilizing 'wholesale pricing plans' saw significant increases in August and September," Staff's presentation said

Total REP complaints for the months of June through September in prior years had been 1,347 in 2018 and 902 in 2017

The presentations were filed in Project 49852

ADVERTISEMENT Copyright 2010-19 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

ERCOT Provides Preliminary Estimates Of Load Reductions During Summer 2019 Peak Days

IMM: Peaker Net Margin At Record Level

Texas PUC Staff Details Increased Complaints Against REPs From Summer 2019

Staff: "Wholesale Pricing Plans" Saw Significant Increases In Complaints During August, September

October 8, 2019

Email This Story

Copyright 2010-19 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

2019 Summer Complaints Against REPs

June 263

July 349

August 650

September 702

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Channel Partner Sales Manager -- Retail Supplier

• NEW! -- Sales Channel Partner Manager -- Retail Supplier

• NEW! -- Sr. Energy Analyst -- DFW

• NEW! -- Channel Manager - Retail Division -- Retail Supplier

• NEW! -- Sr. Accountant -- Retail Supplier -- Houston

• NEW! -- Senior Counsel -- Retail Supplier -- Houston

• NEW! -- Operations/Settlement Analyst

• NEW! -- Retail Energy Supply RFP Coordinator

• NEW! -- Jr. Gas & Power Scheduler/Trader -- Retail Supplier -- Houston

• NEW! -- Marketing Coordinator -- Retail Supplier -- Houston

• Corporate Counsel - Retail Supplier

• Senior Counsel - Regulatory - Retail Supplier

• Sales Representative -- Retail Supplier

|

|

|

|