|

|

|

|

|

PUC Staff: Data Supports End Of Program Assigning Customers To Retail Suppliers; Re-introduction Of Auction For Default Service

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

Staff of the Public Utilities Commission of Ohio said that the auction-based Standard Choice Offer (SCO) should be re-established as the default service to all customers at Dominion East Ohio, including residential and all other classes of non-residential customers, with Staff further saying that current customers assigned to retail suppliers under the Monthly Variable Rate (MVR) program should be transferred back to the SCO

The current applicability of the SCO and MVR varies by customer class.

For residential customers, the SCO, under which a retail auction is conducted to set an SCO adder to NYMEX prices, with winning suppliers awarded the right to serve specific SCO customers at the NYMEX price plus the adder, is the default service provided to customers who have never shopped (or who elect the SCO service).

For residential customers who have shopped (including via municipal aggregation) and whose service with a supplier is then terminated, the customer is placed on SCO for two months. If the customer does not take affirmative action after two months, the customer is assigned to a retail supplier, based on a rotating list, with the customer charged that supplier's Monthly Variable Rate (MVR program). The MVR rate can not exceed any of the supplier's rates listed on the PUCO's Apples to Apples chart; however, some suppliers list on Apples to Apples a single rate that is nearly four times the SCO rate.

For non-residential customers, there is no SCO. Any non-residential customer without a supplier selected by the customer or through opt-out aggregation are assigned to a supplier under the MVR program.

As exclusively first reported by EnergyChoiceMatters.com, the Office of the Ohio Consumers’ Counsel and Ohio Partners for Affordable Energy have petitioned to eliminate the MVR program

As further background, the MVR program was adopted in a 2008 PUCO order, for service to customers who either cancelled their contract with a Competitive Retail Natural Gas Service (CRNGS) provider or whose CRNGS contract ended, if the customer did not affirmatively select the SCO.

In 2013, PUCO eliminated the SCO option for non-residential customers.

In comments on the OCC and OPAE petitions, Staff said, "Staff believes the data supports the motions filed by OCC and OPAE, and therefore Staff asks that the Commission modify the exemption granted to Dominion."

"Specifically, Staff supports the re-establishment of the

SCO as the default service to all customers including residential and all other classes of

non-residential customers," Staff said

Legal Issues

Staff said that R.C. 4929.08 and Ohio Adm.Code 4901:1-19-11(A) allows

the Commission to modify or abrogate any order granting exemption or exit-the-merchant-

function plan under R.C. 4929.04 if both of the following conditions are met:

(1) The Commission determines that the findings upon which the

order was based are no longer valid and that the modification or

abrogation is in the public interest.

(2) The modification or abrogation is not made more than eight

years after the effective date of the order, unless the affected natural

gas company consents.

"Staff finds that the second condition is met because the Commission issued the

2013 Order less than eight years ago," Staff said

However, retail suppliers challenged the ability of PUCO to eliminate the MVR program, given that it was created in 2008, and the 2013 order only eliminated the SCO.

The Retail Energy Supply Association and Interstate Gas Supply said that PUCO lacks authority to order the elimination of the MVR program for residential customers because such action would be a modification to the MVR program established by the Commission’s 2008 Order, an order that was adopted more than eight years ago

"OCC cannot seek to modify the residential MVR assignment in this proceeding because

residential customers were not part of the 2013 Order. That aspect of the exemption granted to

DEO was the subject of the Commission’s 2008 Order," RESA and IGS said

In describing the 2013 order, PUCO Staff and OCC have described the order as "continu[ing]" the MVR program for residential customers.

With respect to non-residential customers, RESA and IGS noted that the 2013 order only eliminated the SCO, and did not modify the MVR program

RESA and IGS said, "OPAE cannot seek to modify the nonresidential MVR assignment because that

assignment of choice-eligible nonresidential customers to a supplier’s posted MVR was not part

of the 2013 Order. That aspect of the exemption granted to DEO was the subject of the

Commission’s 2008 Order."

RESA and IGS said, "Contrary to OPAE’s insinuation that the 2013 Order implemented the MVR

process, choice-eligible nonresidential customers were first assigned a supplier by DEO through

the MVR process following the 2008 Order, not the 2013 Order."

In separately filed comments, Direct Energy said that OCC and OPAE are impermissibly seeking to modify the 2008 order by " bootstrapping" their motions to the 2013 order

"Permitting OCC to attack the [2008] Phase 2 Case stipulation through bootstrapping its challenge

to a subsequent order regarding completely different aspects of DEO’s transition away from

commodity sales service would ignore R.C. 4929.08(A)’s plain language," Direct Energy said

Dominion Energy Ohio (The East Ohio Gas Company, or DEO) said in comments to PUCO that there are, "significant legal questions concerning the Commission’s authority to modify the MVR

mechanism, certainly as it pertains to residential customers."

Dominion Energy Ohio said, "More than eight years have elapsed

since that particular element of DEO’s Choice program was approved. Under R.C. 4929.08, the

Commission may 'only' modify an order granting an exemption if two conditions are met, one

of which is that the 'modification is not made more than eight years after the effective date of the

order, unless the affected natural gas company consents.' ... At a

minimum, there are serious questions about whether this element of DEO’s program may be

modified, questions that are avoided if DEO consents to the modification."

MVR Pricing

Addressing the first condition (listed above) needed for PUCO to change a merchant function exit order, Staff said, "Staff also finds that the first condition is met because the Commission based its

approval, in part, on the understanding that the modification of the 2013 Order would

encourage the development of retail competition ... Staff has been continually

collecting data on the number of customers placed on the MVR and the rates the various

types of customers are paying. The data shows that (1) many of the rates being charged to

MVR customers are unreasonably high; (2) the MVR and/or the elimination of the SCO

for non-residential customers is not encouraging customers to engage with the market,

therefore not further developing the market; and (3) the MVR causes customer confusion.

As a result, Staff believes that the market is not protecting customers."

"The MVR unreasonably allows suppliers an opportunity to bill the natural gas

provided to their assigned MVR customers at a rate that is considerably higher

than the same month’s SCO without incurring any marketing and other costs to acquire and maintain customers. By contrast, the SCO, which itself is a choice for

customers, is almost always the lowest price offered to Dominion East Ohio

residential customers and has repeatedly been among the lowest natural gas prices

in Ohio," Staff said

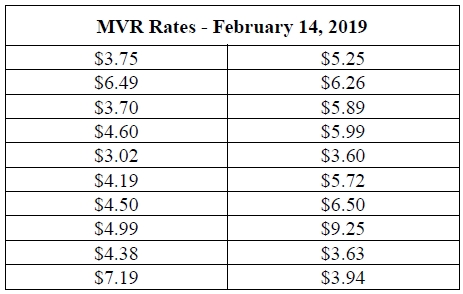

As an example, Staff listed the MVR Rates listed by suppliers on February 14, 2019 (shown below). For reference, Staff noted that the SCO for February 14, 2019 was $3.020 per MCF.

In separately filed comments, the OCC cited similar pricing data

OCC said of the MVR program that, "As a result of this system of gas marketer roulette, customers often find that their

natural gas utility bills increase significantly. For example, 14 of the 21 marketers

currently participating in the Monthly Variable Rate program have rates that are at least

50% higher than Dominion’s Standard Choice Offer (which is a true competitive rate)."

OCC said that, "during the current period of September 13 through October 13, 2019,

Dominion’s Standard Choice Offer is very low at $2.47 per MCF, which is a relatively

safe way for consumers to save a lot of money on their gas bills. Meanwhile, the various

Monthly Variable Rates range from $2.47 to $9.25 per MCF, with an average price of

$4.53 per MCF."

OCC said that, "For a typical consumer using 9 MCF of natural gas per month,

the difference between Verde’s high (and outrageous) rate of $9.25 per MCF and

Dominion’s standard choice rate of $2.47 per MCF would on average be about $61.00

per month on a consumer’s bill."

OCC further said that, "As of September 13, 2019, 14 of the 21 marketers participating in the Monthly

Variable Rate program have rates that are at least 50% higher than Dominion’s Standard

Choice Offer rate. That means residential customers have a 67% chance that the

commodity (gas) portion of their overall utility bill will increase by at least 50% once

they are randomly assigned to the Monthly Variable Rate program.

The gas supplier roulette at the core of the Monthly Variable Rate program results

in most of the customers being worse off with their new marketer than they would be on

the Standard Choice Offer. They could be considerably worse off, depending on which

marketer they are randomly assigned to through the Monthly Variable Rate program. The

market has failed to protect such customers."

"In the September 13 to October 13, 2019 time

frame, all gas marketers but one are charging above the market price for natural gas

service. Some marketers are price-gouging consumers at more than two times the current

market rate," OCC said

While Dominion Energy Ohio (The East Ohio Gas Company, or DEO) noted some, "legitimate concerns about the MVR prices charged by certain suppliers," DEO said in comments to PUCO that, "DEO never had the expectation that MVR rates would consistently be competitive with

the prices set in the Standard Service Offer and Standard Choice Offer (SSO/SCO) auctions."

Dominion Energy Ohio said, "Indeed, the MVR and SSO/SCO rates are apples and oranges: The SSO/SCO prices set in the

auction reflect market conditions and supplier economics (including the use of DEO on-system

storage) at a single point in time and cannot reflect market conditions throughout the entire 12

months that a given retail price adjustment is in effect. In addition, auction outcomes generally

reflect the expectation that SSO/SCO customers received in the auction process will remain with

a supplier for a full 12-month period from April through the following March, whereas MVR

prices are offered to new and existing customers at any time and for any duration during that 12-month period."

Dominion Energy Ohio noted, "To that end, a

limitation was approved from the beginning—namely, that the MVR rate could not exceed the

lowest variable rate posted by that supplier on the Apples-to-Apples chart. This was based on the

assumption that suppliers would be competing aggressively to add more customers to their pool.

Experience, however, has shown that some suppliers are not competing to increase their market share. Some have instead elected instead to post substantially higher MVR rates, with the evident

intent of reaping an inflated margin on rotationally assigned customers, for however long they

remain with that supplier."

Dominion Energy Ohio said, "DEO does not support this practice, but it is important to recognize how limited the

problem is. If certain suppliers have evaded the originally designed 'guard rail' (capping the

MVR at the supplier’s lowest variable rate), then the optimal solution may be to fix the guard

rail. But given the evidence [noted below] that the MVR is actually working as a transitional mechanism, DEO

does not believe that the entire mechanism should be scrapped without vigorously exploring

potential alternatives."

RESA and IGS said that, "OCC has made no showing that the modification it requests is in the public interest.

Although the SCO may currently be lower than the MVR for some suppliers, there is no

guarantee that will be true in future periods. Moreover and importantly, the purpose of the MVR

is not to provide the lowest price to customers that are not making a choice. Rather, the MVR

should and is acting as an incentive for residential customers coming out of shopping contracts or

out of aggregations to make a choice between shopping, returning to an aggregation or going to

the SCO. That additional engagement in the competitive market (making a choice) is in the

public interest, because increased competition will lead to overall lower natural gas supply costs."

Number of Customers Served Under MVR

Staff further said, "the Commission based the 2013 Order on the belief that customers

will be protected by the market. As the data above shows, the market has not had

the protective effect as the Commission believed it would and customers have

been paying unreasonably high bills as a result."

Staff further said, "Notwithstanding the prices MVR customers are paying, the number of customers

taking service under the MVR does not vary significantly month to month and has

not meaningfully decreased since Dominion’s exit, meaning that customers are

remaining on the assigned rate for months at a time. This demonstrates that the

MVR has not been successful in encouraging customers to avail themselves of

other competitive options."

Staff further said, "The subsequent data collected by Staff shows that

the average number of non-residential customers that currently remain on the

MVR service is over 12,000 per month. Thus, after six years of no SCO option

for non-residential customers, the MVR has failed to encourage market

development. Staff is concerned about the financial harm done to customers who

stay on the MVR for an extended period of time. Staff believes that this effect is

contrary to the effect the Commission sought to achieve."

OCC likewise said that the MVR program is not promoting customer shopping.

OCC said that, "The PUCO established the Monthly Variable Rate as a transition mechanism to

promote shopping among Dominion’s residential customers. This has not happened. In

the first quarter of 2015 -- just before Dominion instituted the Monthly Variable Rate -

72.4% of Dominion’s residential customers were served by a marketer. As of the first

quarter of 2019 (the most recent period available), the percentage of residential customers who shop for natural gas in Dominion’s service territory dropped to 68.2%. During the

period that the Monthly Variable Rate program has been in existence, the number of

Dominion residential customers who shopped for natural gas dropped from 803,485 to

765,215. By contrast, in the same period natural gas shopping by residential customers

statewide increased from 51.6% to 54.8%. Residential customers in Dominion’s service

territory are shopping less for natural gas, while residential customers in other parts of the

state are shopping more."

Dominion Energy Ohio (The East Ohio Gas Company) offered a different view on the number of customers on the MVR, stating that "very few customers

remain on the MVR."

Dominion Energy Ohio said, "Notwithstanding legitimate concerns about

the MVR prices charged by certain suppliers, evidence suggests that the MVR has been

successful in prompting customer engagement—in the residential market, very few customers

remain on the MVR. While numbers vary each month, monthly participation in 2019 has ranged

from as low as approximately 2,400 customers to as high as 3,600 customers out of DEO’s

approximately one million residential customers."

Retail supplier Dominion Energy Solutions likewise noted that the utility Dominion Energy Ohio has well over 1 million residential customers, of which, only some 2,600 are served under the MVR program.

Dominion Energy Solutions further said, "Further, information

provided by DEO in discovery shows that some 75 percent of these residential customers move

out of the MVR program within three years, which is evidence of the kind of engagement that

the program was intended to foster. Thus, it is fair to say that, by and large, the residential MVR

program has achieved the intended result of encouraging customer engagement."

Recommended Relief

Staff said that, "Eliminating the MVR

and transferring the current MVR customers back to the SCO would be beneficial

to the vast majority of current MVR customers who are in the Dominion market

and would continue to allow them to become customers of fair and competitive

retail shopping programs. This would further the potential benefits from the

development of the market."

Dominion Energy Ohio said that although the MVR has largely served its purpose, Dominion Energy Ohio does believe that it could be improved.

Dominion Energy Ohio (DEO) recommends that any MVR pricing approach should have the following attributes:

• A reasonable basis that generally reflects natural gas commodity market

conditions and competitive prices within its commodity market.

• A methodology that can be readily explained and summarized to customers, to

assure them that there is a reasonable basis for the price they pay.

• A process that DEO can readily administer within its existing system and process.

"In DEO’s view, these objectives are reasonable and eminently achievable. DEO sees no reason

why these objectives cannot be achieved in resolving the Motions," Dominion Energy Ohio said

Consumer advocates sought elimination of the MVR and re-establishment of the SCO consistent with their original motions. "The random assignment of customers through the Monthly Variable Rate program

is a fiasco in Dominion’s area," OCC said

Retail suppliers opposed consumer advocates' sought relief. However, suppliers generally were open to collaborative discussions concerning improvements to the existing programs

Dominion Energy Solutions offered specific changes to the program at Dominion East Ohio, including an eligibility criteria for MVR suppliers, pricing restrictions for small MVR suppliers, and limiting a supplier's ability to serve a specific MVR customer to a specific term (with the customer moved to the next rotating MVR supplier after such term). See our related story today here for more details on Dominion Energy Solutions's proposals

Case No. 18-1419-GA-EXM

ADVERTISEMENT Copyright 2010-19 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

PUC Staff: Current Customers Assigned To Retail Supplier Under Monthly Rate Program Should Be Transferred Back To Auction-Based Service

PUC Staff: Market Is Not Protecting Customers

Retail Suppliers Say PUC Lacks Authority To Change Customer Assignment Program Due To Time Limit Placed In Rules

OCC: Program "Gouges" Customers; "Roulette"; "Fiasco"

October 14, 2019

Email This Story

Copyright 2010-19 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Channel Partner Sales Manager -- Retail Supplier

• NEW! -- Sales Channel Partner Manager -- Retail Supplier

• NEW! -- Sr. Energy Analyst -- DFW

• NEW! -- Channel Manager - Retail Division -- Retail Supplier

• NEW! -- Sr. Accountant -- Retail Supplier -- Houston

• NEW! -- Senior Counsel -- Retail Supplier -- Houston

• NEW! -- Operations/Settlement Analyst

• NEW! -- Retail Energy Supply RFP Coordinator

• NEW! -- Jr. Gas & Power Scheduler/Trader -- Retail Supplier -- Houston

• NEW! -- Marketing Coordinator -- Retail Supplier -- Houston

• Corporate Counsel - Retail Supplier

• Senior Counsel - Regulatory - Retail Supplier

• Sales Representative -- Retail Supplier

|

|

|

|