|

|

|

|

|

Regulator: Retail Supplier Applicants Increasingly "Not Forthcoming" About Compliance History In Other States

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

The Connecticut PURA has posted an annual report to the legislation on retail electric competition

In a discussion in the report about new license applicant activity, PURA noted that, "Due to suppliers’ substantial regulatory histories in other jurisdictions, the time to process a supplier application is increasing. Every application requires research into infractions committed in other jurisdictions, which can be voluminous depending on how long the supplier has been active and in how many other jurisdictions."

Furthermore, PURA said that, "Moreover, the Authority is increasingly finding that suppliers are not forthcoming with this information on the initial application, requiring research by the Authority and subsequent interrogatories. See e.g., Docket No. 19-08-21, Interrogatory SEU-9; Docket No. 19-06-05, Interrogatory SEU-29."

The report also included a review of electric supplier rates in comparison to default service, including residential customers on legacy variable rates that are permitted to continue under the ban on variable rates.

PURA said that, as of January 2020, 24,891 residential customers of retail electric suppliers remained on variable rates despite Conn. Gen. Stat. § 16-245o(h)(1) discontinuing new variable rates for residential customers on October 1, 2015 (5,891 UI customers and 19,051 Eversource customers). These customers enrolled on variable rate contracts initially executed prior to October 2015; the statute included a grandfathering provision for contracts executed pre-October 2015.

Of these customers paying variable rates, almost 21,000 paid greater than 12 cents per kWh, with almost 6,700 of those paying greater than 15 cents per kWh.

PURA noted that, "As a basis of comparison, Eversource standard service rates in 2019 were 10.143 and 8.123 cents per kWh and UI standard service rates in 2019 were 11.2263 and 8.3532 cents per kWh. UI territory saw a greater percentage of variable rate customers paying higher rates, with 42% of variable rates customers paying rates greater than 15 cents per kWh."

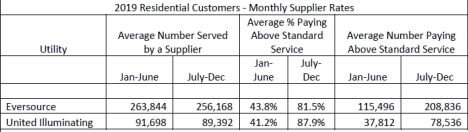

Concerning the overall residential market, PURA noted that a large number of customers with retail suppliers pay a rate in excess of the default service rate, with the number of such customers eclipsing 80% in the second half of 2019

"The data indicates that during the first half of 2019, over 40% of customers enrolled with a supplier paid greater than the Standard Service rate for their generation supply. For the first half of 2019, the average supplier rate in the Eversource territory was $0.10569 per kWh (compared to Standard Service rate of $0.10143 per kWh) and the average supplier rate in the UI territory was $0.110971 per kWh (compared to Standard Service rate of $0.112263 per kWh)," PURA said

"The percentage of supplier customers paying more than Standard Service increased significantly in the second half of 2019, with almost 88% of UI customers enrolled with suppliers paying more than Standard Service and 81.5% of Eversource’s customers enrolled with a supplier paying more than Standard Service. During the second half of 2019, the average supplier rate in the Eversource territory was $0.102033 per kWh, compared to a Standard Service rate of $0.8123 per kWh; in the UI territory, the average supplier rate was $0.108493 per kWh, compared to a Standard Service rate of $083532 per kWh," PURA said

PURA's findings are summarized below:

PURA said that, "The Authority presents this information as a snapshot of supplier rates charged in 2019, but recognizes that supplier contracts may last for longer than six-month Standard Service rates and therefore may reflect risk premiums not reflected in Standard Service rates. Supplier rates may include other terms (such as gift card incentives, cancellation fees, or monthly fees) that are not calculated in the rates. In addition, some customers may be served under contracts with renewable energy content that exceeds Connecticut’s minimum renewable portfolio standard (RPS). The generation supply rate for such offers may exceed the Standard Service rate."

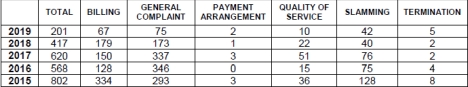

PURA also discussed customer complaints against suppliers, with complaints falling by more than half during 2019

Complaints against retail suppliers were 201 in 2019, versus 417 in 2018, as noted in the table below:

PURA said that, "Calendar year 2019 saw a reduction in the number of supplier complaints overall. The

Authority attributes this reduction, at least in part, to its enhanced education and outreach

efforts towards making customers more aware of the electric supplier market. Ensuring

residential customers monitor the Supply Summary on their bill is an ongoing effort by the

Authority."

PURA in the report recounted the various previously reported investigation and enforcement actions it undertook in 2019, noting that, "in 2019 the Authority also significantly

increased its monitoring of the supplier market as a whole."

"Throughout 2019, Authority

staff members conducted seven supplier investigations and have already begun four

more in 2020. These investigations identified and remedied various regulatory violations

by specific suppliers and the Authority will continue to use them as a means of ensuring

suppliers are complying with applicable statutes and regulations moving forward.

Marketing standards have been proposed and legislative changes have been requested

that would further enhance the Authority’s ability to monitor the supplier market," PURA said

PURA also provided visitor stats for its EnergizeCT.com retail supplier rate board.

The Supplier choice information on the EnergizeCT.com website had over 2 million page views in 2019, by more than 257,000 different visitors. Citing site data, PURA said that customers tend to shop for a supplier more in the winter, when prices in New England are traditionally higher (winter peak).

Summarizing overall migration, PURA said, as of December 2019, Eversource and UI served a total of 1,595,155 customer

accounts in Connecticut. Of the total accounts, 1,433,736 were residential, 160,368 were

commercial, and 1,051 accounts were last resort service (LRS). Twenty-six percent, or

415,421 of the total number of customer accounts chose to receive service from a

supplier. These accounts receiving service from a supplier were comprised of 340,719

residential accounts, 73,778 commercial accounts and 924 LRS accounts.

Since 2013, the number of customers choosing to receive service with an electric supplier has consistently decreased. "This decrease could be explained by several factors, including, but not limited to: a change in method of procuring standard service to allow it a more competitive rate; or, a diminishing differential between suppliers’ charged rates versus standard service rates," PURA said

Docket 19-01-08

ADVERTISEMENT Copyright 2010-20 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Report: Over 80% Of Residential Retail Supply Customers Paid Rate Higher Than Default Service In Second Half Of 2019

Regulator Notes Thousands Of Legacy Variable Rate Customers Paying Rates Above 15¢

Complaints Against Retail Suppliers Fall By Half

March 31, 2020

Email This Story

Copyright 2010-20 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Energy Procurement Manager

• NEW! -- Channel Relations Manager -- Retail Supplier

• NEW! -- Senior Retail Energy Markets Pricing Analyst

• NEW! -- Energy Market Analyst -- DFW

• Senior Consultant - Competitive Energy Markets -- Houston

|

|

|

|