|

|

|

|

|

Just Energy Announces Recapitalization And Pending Board Renewal, Conclusion Of Strategic Review

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

Just Energy Group Inc. ('Just Energy' or the 'Company') today announced, "the conclusion of its strategic review and a comprehensive plan to strengthen and de-risk the business, positioning the Company for sustainable growth as an independent industry leader."

Just Energy also reported earnings for the quarter and fiscal year ending March 31, 2020

Just Energy announced a proposed recapitalization plan (the 'Recapitalization') that the Company said, "will be facilitated through a plan of arrangement (the 'Plan of Arrangement') under the Canada Business Corporations Act ('CBCA'), which involves a raise of C$100 million in committed new equity, reduction of overall debt by approximately C$275 million, and materially lower annual cash interest payments."

Just Energy announced, "Support for the Recapitalization from senior lenders and commitment to underwrite the C$100 million equity subscription offering from existing senior unsecured term loan lenders, Sagard Credit Partners, LP and certain funds managed by a leading US-based global fixed income asset manager (the 'Initial Backstoppers')[.]"

Just Energy announced, "A renewed slate of seven directors, of which at least four will be new directors, will stand for election to the Company’s Board at the Company’s Annual General Meeting of shareholders, which is postponed from the August 11, 2020 date previously set, in conjunction with a Special Meeting for approval of the Plan of Arrangement[.]"

Specifically, Just Energy said that the Recapitalization includes:

• Exchange of C$100 million 6.75% subordinated convertible debentures due March 31, 2023 and C$160 million 6.75% subordinated convertible debentures due December 31, 2021 (TSX: (the 'Subordinated Convertible Debentures') for new common equity;

• Extension of C$335 million credit facilities by three years to December 2023, with revised covenants and a schedule of commitment reductions throughout the term;

• Existing senior unsecured term loan due September 12, 2023 (the 'Existing Term Loan') and the remaining convertible bonds due December 31, 2020 (the 'Eurobond') shall be exchanged for a New Term Loan due March 2024 with initial interest to be paid-in-kind and new common equity;

• Exchange of all 8.50%, fixed-to-floating rate, cumulative, redeemable, perpetual preferred shares (the 'Preferred Shares) into new common equity;

• New cash equity investment commitment of C$100 million;

• Initial reduction of annual cash interest expense by approximately C$45 million; and

In total, the Recapitalization will result in a reduction of approximately C$535 million in net debt and preferred shares, Just Energy said

"The implementation of the Recapitalization is expected in September 2020, pending court and securityholder approvals required under the CBCA, as well as applicable approvals by the Toronto Stock Exchange. Just Energy’s Board of Directors has approved the Recapitalization and unanimously recommends all holders of existing subordinated convertible debentures, preferred shares and common shares support the Recapitalization. Just Energy’s financial advisor, BMO Capital Markets, has provided an opinion to Just Energy’s Board of Directors that the terms of the Recapitalization are fair, from a financial point of view, to the holders of its Eurobond, Subordinated Convertible Debentures, Preferred Shares, and common shares," Just Energy said

"The Company has obtained a preliminary interim order from the Ontario Superior Court of Justice which, among other things, grants a limited stay of proceedings and establishes the record date for voting of securityholders with respect to the Plan of Arrangement as July 8, 2020. The Company will be seeking an interim order in the very near term," Just Energy said

"The Company also intends to file an information circular describing the transaction in detail in the near term, and expects to seek approval for the proposed Plan of Arrangement at a Special Meeting of Shareholders and meetings of applicable creditor classes (collectively, the 'Meetings') to be scheduled for late August. The Company will also postpone its Annual General Meeting from August 11, 2020 to the same date, enabling it to be held in conjunction with the Special Meeting," Just Energy said

"The Company’s full slate of director candidates for its renewed board will be included in the forthcoming information circular for the Special and Annual General Meeting of shareholders. The size of the Board will be fixed at seven directors, of which at least four will be new directors and with a separate Chair and CEO," Just Energy said

Details of the Recapitalization and Plan of Arrangement

The Plan of Arrangement

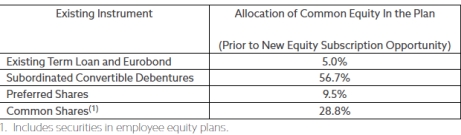

Pursuant to the Plan of Arrangement, the common equity in the plan (before the common equity subscription opportunity) will be allocated as follows:

Further details of the Plan of Arrangement include:

• The plan will also include a 1-for-33 share consolidation

• A total of 16.5 million common shares will be outstanding as 'Common Equity in the Plan' (prior to the New Equity Subscription Opportunity)

• Upon closing of the plan, accrued and unpaid interest to June 30, 2020 on the 6.75% subordinated convertible debentures due March 2023 shall be paid in cash

• Interest following June 30, 2020 on the Subordinated Convertible Debentures will not be paid in cash and will be exchanged for new common equity under the Plan of Arrangement.

• Interest to June 30, 2020 on the 6.75% subordinated convertible debentures due December 2021 was already paid in cash on that date in accordance with the terms of that debenture

• The Existing Term Loan and Eurobond will be replaced with a new US$205.9 million senior unsecured term loan due March 2024 (the 'New Term Loan', described further below)

• Holders of the Existing Term Loan representing 96% of the class have committed to vote in favour of the transaction

New Term Loan

Key features of the New Term Loan include:

• Interest will be paid in kind until March 31, 2022, following which interest may be partially paid in cash

• The interest rate will be 10.25% for any interest paid in kind and 9.75% for any interest paid in cash

• The payment/prepayment fee has been reduced to 5% for principal repayments at all times at or prior to maturity

• Holders of Eurobonds will receive, in addition to the share-related amounts set out in the table below, US$952.38 of New Term Loan for every US$1,000 of principal amount of Eurobonds they hold, subject to applicable laws

Extended Credit Facility

• Concurrent with the implementation of the Plan of Arrangement, the Company’s secured credit facility will be amended, including as follows:

• Maturity date to be extended from September 1, 2020 to December 31, 2023

• Scheduled mandatory repayments to permanently reduce the facility availability over the term of the agreement by an aggregate of C$245,000,000

• Amended financial covenants that reduce the maximum consolidated senior debt to EBITDA ratio over time

The New Equity Subscription Opportunity

• Holders of record of the Company’s Existing Term Loan, Eurobond, Subordinated Convertible Debentures, Preferred Shares and common shares as of July 23, 2020 will be entitled to participate in the new equity subscription opportunity (the 'New Equity Subscription Opportunity') in the amounts specified below

• A total of 29.3 million new common shares will be available for subscription pursuant to the New Equity Subscription Opportunity at a price per share of C$3.412

• The New Equity Subscription Opportunity is non-transferrable and there will be no listed market for the Subscription Opportunity

• The Initial Backstoppers have entered into a US$73 million backstop commitment (equivalent to C$100 million at an exchange rate of US$0.73 per C$1.00)

• The Initial Backstoppers will receive 0.4 million common shares (after the Recapitalization Plan and New Equity Subscription Opportunity have closed) as an Initial Backstop Commitment Fee

• The Company may terminate the initial backstop commitment on or prior to July 18, 2020 if additional backstoppers are identified for at least C$100 million on terms that are superior to the initial backstop commitment

• Under terms of Initial Backstop Agreement, the Company may contract with additional backstoppers (the 'Additional Backstoppers') for up to C$50 million of the Backstop commitments by July 23, 2020. Alpha-IR will direct any enquiries with respect to Additional Backstop participation

• Backstop Funding Fee of 0.5 million common shares (after the Recapitalization Plan and New Equity Subscription Opportunity have closed) will be provided on a pro rata basis to Initial/Additional Backstoppers in proportion to their Backstop commitment amount

• The backstop commitments are subject to a minimum amount of shares being offered to backstoppers at the subscription price. If that minimum threshold (US$20.35 million) is not achieved, the Company shall issue additional Shares, to be purchased at the subscription price, to fulfill the remaining minimum obligation.

• Completion of the New Equity Subscription Opportunity is conditional on the completion of the Recapitalization Plan

• The common shares issuable pursuant to the New Equity Subscription Opportunity will be freely tradeable and the Company will apply to list these shares on both the Toronto Stock Exchange and the New York Stock Exchange (other than any common shares issued to the Initial/Additional Backstoppers in the United States, which will subject to U.S. resale restrictions)

Just Energy said, "In connection with the Recapitalization, the Company has entered into a support agreement with all of its lenders under the Existing Term Loan whereby such holders have, among other things, agreed to support the Recapitalization. The Company also entered into an amendment and consent agreement with its senior secured lenders whereby such lenders have, among other things, agreed to support the Recapitalization and extend the facility maturity date to allow for the Recapitalization to be completed."

Just Energy said that it is, "Business as usual for employees, customers and suppliers enhanced by the relationship with a financially stronger Just Energy – they will not be affected by the Recapitalization[.]"

Earnings

Just Energy reported earnings for the quarter and fiscal year ending March 31, 2020 (fiscal 2020)

Just Energy's MD&A was filed shortly before publication of this story. An earnings call will be held later this morning. An additional report will follow

For the three months ended March 31, 2020, Base EBITDA from Continuing Operations was $74.6 million versus $59.5 million a year ago (all earnings data in Canadian $)

For the three months ended March 31, 2020, Base Gross Margin was $180.4 million, versus $172.4 million a year ago

For the three months ended March 31, 2020, sales were $675.7 million, versus $797.4 million a year ago

In an MD&A, Just Energy stated that it was serving 3,396,000 total Residential Customer Equivalents (RCEs) as of March 31, 2020 in its Commodity business, versus 3,515,000 as of December 31, 2019

Just Energy said that its total customer count as of March 31, 2020 was 1,107,000

Just Energy stated, "The recent market exits demonstrate Just Energy’s commitment to focus on its North American operations. The sale of the U.K., Ireland and Japan operations are now complete, as is the sale of the Company’s Georgia assets."

"Just Energy continues to actively evaluate the optimal strategy for our remaining non-core operations, particularly value-added products considering the Company’s renewed focus on its commodity business," Just Energy said

"In fiscal 2020, the Company achieved a total reduction in spend (overhead and capital) of approximately $70 million relative to fiscal 2019. In fiscal 2021 the Company expects to benefit from the full run-rate of these savings and achieve a sustainable spending rate of approximately $100 million less than fiscal 2019. The Company is committed to continuously evaluating all spend and identifying future opportunities to streamline the business," Just Energy said

Just Energy said that, for the fiscal year, "The Consumer attrition rate increased five percentage points to 26% and the Commercial attrition rate increased two percentage points to 9%. Consumer attrition was severely affected in FY2020 by the rectified Texas enrollment issues. The Company expects Consumer attrition rates to subside and be in line with historical lower levels during early FY2021."

Just Energy said that, for the fiscal year, "The Consumer renewal rate increased to 77%, and the Commercial renewal rate decreased by one percentage point to 50% as compared to the prior year. The increase in the overall Consumer renewal rate was driven by improved retention offerings, offset by attrition while the decline in the Commercial renewal rate reflected a very competitive market for Commercial renewals with competitors pricing aggressively and Just Energy’s focus on improving retained customers’ profitability rather than pursuing low margin growth."

ADVERTISEMENT Copyright 2010-20 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Just Energy, "Plans To Remain Independent"

Reports 4Q, Full Year Earnings

July 8, 2020

Email This Story

Copyright 2010-20 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! --

Retail Energy Account Executive -- Houston

• NEW! --

Business Development Manager

• NEW! --

Senior Manager, Energy Market Research & Analytics -- Houston

|

|

|

|