|

|

|

|

|

Pennsylvania PUC Asks EDCs About Alternatives To Proposed Use Of Proxy Capacity Price In Upcoming Default Service Auctions

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

The Pennsylvania PUC has directed the FirstEnergy electric distribution companies to discuss any other alternatives considered, other than the EDCs' proposed use of a proxy price for capacity, to be used in upcoming full requirements default service auctions for delivery periods for which a PJM Base Residual Auction has not yet been conducted, due to ongoing FERC uncertainty.

Each of the FirstEnergy EDCs had petitioned the PUC for a modification of their Supplier Master Agreement ('SMA') to include a capacity proxy price

('CPP') for PJM Interconnection LLC’s ('PJM') 2022/2023 delivery year as part of the

Companies’ upcoming default service auctions, including an upcoming October 2020 auction, which includes 24-month fixed-price products that

extend into the 2022/2023 delivery year.

The EDCs are proposing to use the proposed CPP for upcoming default

service auctions that include fixed 24-month products extending into the 2022/2023 delivery year --

specifically the Companies’ October 2020, January 2021, and April 2021 auctions. Once the

2022/2023 capacity prices are determined at PJM, the use of a CPP for future auctions will no longer be applicable.

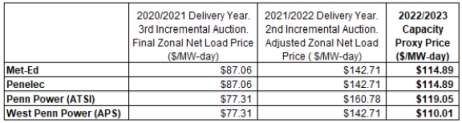

The following chart illustrates the Companies’ proposed CPP by EDC service

territory for the 2022 to 2023 delivery year:

The EDCs said that the proposed CPP for each Company is the average of the capacity prices for

2020/2021 and 2021/2022, i.e., the two years preceding the 2022/2023 delivery year. The most

recent data available from PJM are used for the 2020/2021 and 2021/2022 delivery years.

The PUC directed the EDCs to submit a response to the following: "Please describe any other methodologies considered and provide a detailed explanation as to why the capacity proxy price was selected over any other alternatives."

In their original petition, the EDCs had said that, "A CPP is the preferred methodology for addressing the unknown capacity price

issue because it permits utilities to preserve their diverse auction portfolio of different fixed

product lengths in order to offer the most competitive pricing to customers. This methodology is

wholly consistent with the Commission’s requirements to offer default service at the 'least cost

over time,' which can be achieved by offering a 'prudent mix' of default service products."

"The impact of the CPP on customers is neutral, i.e., they will be charged the actual

capacity price determined at PJM during the 2022/2023 delivery year. Winning default service

suppliers of the Companies’ 24-month fixed products will be paid the auction closing price for the

load served subject to a subsequent true-up for the 2022/2023 delivery year. The true-up would

be conducted as follows: if the actual PJM capacity price turns out to exceed the CPP, then the

amount paid to default service suppliers will be increased by the difference (actual capacity price

charged to them by PJM less the CPP); alternatively, if the actual PJM capacity price turns out to

be less than the CPP, then the amount paid to suppliers will be reduced by the difference (the CPP

less the actual PJM capacity charged to suppliers). The Companies will collect or credit their Price

to Compare Default Service Rate Riders with the corresponding amounts," the EDCs said in their original petition

"The adoption of a CPP would promote competitive default service auctions for 24-

month fixed products that extend into the 2022/2023 deliver year. If a CPP is not adopted, an

increased risk exists that bidders will either include a risk premium as part of their bids for these

products or opt not to participate in these auctions altogether. If the auction results are not

competitive, the Commission may reject the results, which would result in the Companies being

required to procure the remaining default service supply," the EDCs said in their original petition

"The Companies are aware that the Commission recently approved Duquesne Light

Company’s ('Duquesne') Petition to Modify its Default Service Plan, which shortened the

products available in Duquesne’s upcoming auction from 24 to 12 months to address this same unknown capacity price issue. The Companies are proposing a different methodology here for

a few reasons. First, the Companies seek to preserve the diverse auction portfolio including

products of 3, 12, and 24 months approved in the Companies’ most recent DSP proceeding.

Second, neighboring state commissions in New Jersey, Maryland, and Ohio conducted

proceedings to evaluate the potential solutions for the unknown capacity price issue and approved

a CPP approach. The Companies seek to adopt an approach that aligns with their sister utilities

in these jurisdictions," the EDCs said in their original petition

Docket P-2020-3021424 et al.

ADVERTISEMENT Copyright 2010-20 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

September 3, 2020

Email This Story

Copyright 2010-20 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- VP, Finance -- Retail Supplier

• NEW! -- Sr. Sales Executive -- Retail Supplier

• NEW! -- Energy Systems Analyst -- Retail Supplier

• Billing Specialist -- Retail Supplier

-- Texas

•

Retail Energy Account Executive -- Houston

•

Business Development Manager

|

|

|

|