|

|

|

|

|

Vistra Announces New ERCOT Generation Developments Totaling 1,000 MW

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

Vistra, the parent of TXU Energy and various other retail energy brands, has launched Vistra Zero, a portfolio of zero-carbon power generation facilities, including seven new developments announced today in its primary market of ERCOT that total nearly 1,000 megawatts.

Vistra also announced its intention to retire all of its generation subsidiaries' coal plants in Illinois and Ohio.

Vistra, which is already developing what the company said is the world's largest battery energy storage project, the 400-MW/1,600-MWh Moss Landing Energy Storage Facility in California, today announced that it is breaking ground on six new solar projects and one battery energy storage project in Texas. These new zero-carbon developments, which are part of a newly launched Vistra Zero portfolio, represent a capital investment of approximately $850 million and are all located in the ERCOT market. Details are as follows:

Expected online in 2021

• Andrews Solar Facility, Andrews County - 100 MW

• Brightside Solar Facility, Live Oak County - 50 MW

• Emerald Grove Solar Facility, Crane County - 108 MW

• Upton 2 Solar and Energy Storage Facility - Phase III, Upton County - 10 MW solar; Additional solar capacity to be added to the already operational facility, bringing its total solar capacity to 190 MW

Expected online in 2022

• DeCordova Energy Storage Facility, Hood County - 260 MW/260 MWh; Co-located on site of Luminant's natural gas-fueled DeCordova Power Plant

• Forest Grove Solar Facility, Henderson County - 200 MW

• Oak Hill Solar Facility, Rusk County - 200 MW

The Vistra Zero portfolio also includes the company's existing nuclear, renewable, and energy storage facilities:

• Comanche Peak Nuclear Power Plant (2,300 MW)

• Upton 2 Solar (180 MW) and Energy Storage Facility (10 MW/42 MWh)

• Moss Landing Energy Storage Facility (400 MW/1,600 MWh) - 300 MW Phase I expected online December 2020; 100 MW Phase II expected online by August 2021

• Oakland Energy Storage Facility (36.25 MW/ 145 MWh) - expected online January 2022

Inclusive of its new carbon-free projects, the Vistra Zero portfolio now consists of approximately 4,000 MW of zero-carbon assets. In addition, the company continues to evaluate additional solar and battery projects, including more than 1,000 MW in Texas, more than 1,000 MW in California, and approximately 450 MW in Illinois under the proposed Coal to Solar and Energy Storage Act. Vistra is also exploring potential future development opportunities at many of the company's existing power plant sites.

Vistra also announced its next phase of coal plant closures in Illinois and Ohio. The company expects to retire seven Luminant power plants, of which the company owns a combined capacity of more than 6,800 MW, between 2022 and 2027.

By year-end 2022

• Edwards Power Plant, Bartonville, IL (MISO) - 585 MW previously announced

By year-end 2025 or sooner should economic or other conditions dictate

• Baldwin Power Plant, Baldwin, IL (MISO) - 1,185 MW

• Joppa Power Plant, Joppa, IL (MISO) - 1,002 MW (plus 239 MW of gas-fueled combustion turbines)1

By year-end 2027 or sooner should economic or other conditions dictate

• Kincaid Power Plant, Kincaid, IL (PJM) - 1,108 MW

• Miami Fort Power Plant, North Bend, OH (PJM) - 1,020 MW

• Newton Power Plant, Newton, IL (MISO) - 615 MW

• Zimmer Power Plant, Moscow, OH (PJM) - 1,300 MW

"These plants, especially those operating in the irreparably dysfunctional MISO market, remain economically challenged," Vistra said

Today's retirement announcements are also prompted by upcoming Environmental Protection Agency filing deadlines, which require either significant capital expenditures for compliance or retirement declarations.

Financial Update

Also this morning, Vistra provided certain financial updates, including raising and narrowing its 2020 financial guidance, initiating its 2021 financial guidance, and announcing its long-term capital allocation plan. Specifically, Vistra:

Raised and narrowed its 2020 financial guidance ($ in millions):

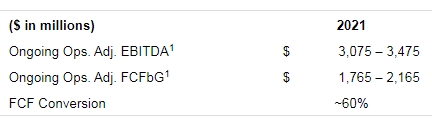

Initiated its 2021 financial guidance ($ in millions):

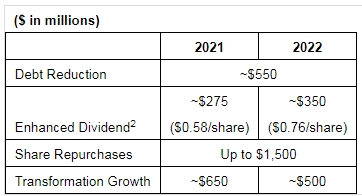

Announced its long-term capital allocation plan:

As depicted in the table above, in September 2020 Vistra's board of directors authorized a $1.5 billion share repurchase program. The program commences Jan. 1, 2021, does not expire, and replaces any authorization that remains at the end of 2020 under Vistra's existing repurchase plan.

"With today's financial updates, Vistra is on track to beat its original guidance midpoint for the fifth year in a row and potentially even exceed the top end of its original guidance range -- despite a pandemic tail event in 2020. In addition, with the continued debt reduction in 2021 and 2022 Vistra believes it is well-positioned to achieve improved credit ratings including the potential to achieve investment grade ratings over this timeframe. The company also believes it is well-positioned to consistently deliver strong long-term earnings into the future, while investing in the transformation of the company and returning a significant amount of its free cash flow to its financial stakeholders on an annual basis," the company said

Notes from charts:

Note #1: Excludes the Asset Closure segment. Ongoing Operations Adjusted EBITDA and Ongoing Operations Adjusted FCFbG are non-GAAP financial measures.

Note #2: Management recommendation; subject to Board of Director's approval at the applicable time.

ADVERTISEMENT Copyright 2010-20 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Vistra Raises 2020 Financial Guidance, Announces Long-Term Capital Allocation Plan

September 29, 2020

Email This Story

Copyright 2010-20 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Energy Pricing Analyst -- Houston

• NEW! -- Retail Energy Account Executive -- Houston

• NEW! -- Sr. Sales Executive -- Retail Supplier

• Energy Systems Analyst -- Retail Supplier

• Billing Specialist -- Retail Supplier

-- Texas

|

|

|

|