|

|

|

|

|

NRG Reports Nearly $1 Billion Negative Impact From Winter Storm Uri For Q1; Total Impact Will Be Lower Over Time

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

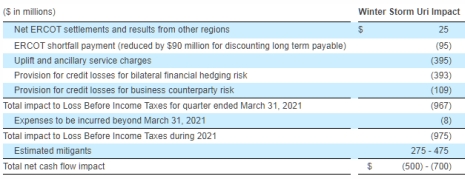

In reporting quarterly earnings, NRG Energy ("NRG" or "the Company") said that, during the quarter ended March 31, 2021, Winter Storm Uri's financial impact was a loss of $967 million.

"Based on forecasted expenses and estimated mitigants, the total cash impact from Winter Storm Uri is expected to be in the range of $500 to $700 million over time," NRG said

NRG detailed the Winter Storm Uri impacts as follows:

In a presentation, NRG described $393 million of the negative impact from Uri as, "Direct Energy Financial Hedge Non-Performance – Isolated Issue; One Heat Rate Call Option (HRCO) non-performance".

In a presentation, NRG described $95 million of the negative impact from Uri as, "ERCOT Defaults Primarily Due to Regulated Co-ops; Brazos / Rayburn seeking to shift costs to other ERCOT customers".

In a presentation, NRG described $395 million of the negative impact from Uri as, "Unhedgeable Uplift Costs Primarily During Final 32 Hours; >10 GW of reserves while maintaining EEA3 ($9,000/MWh pricing)".

"During the quarter ended March 31, 2021, Winter Storm Uri's financial impact was a loss of $967 million. The impact is driven by resettlement data, ERCOT system wide counterparty defaults, provisions for credits losses, increased uplift charges to load, ancillary charges and other estimates including results from other regions. The Company expects the total 2021 loss before income tax to be $975 million, and a net cash flow impact of $350-550 million, after deducting $150 million of bill credits owed to large Commercial and Industrial (C&I) customers to be paid in 2022 and $275-475 million of estimated mitigants that the Company is pursuing. These potential offsets include, but are not limited to, customer bad debt mitigation, counterparty default recovery, ERCOT default and uplift regulatory securitization, and one-time cost savings," NRG said

Excluding the impact of Winter Storm Uri, for the first quarter of 2021, NRG reported Adjusted EBITDA of $567 million, versus $349 million a year ago, driven by the Direct Energy acquisition which closed on Jan. 5, 2021

NRG reported its segment Adjusted EBITDA results excluding the impact from Winter Storm Uri as follows: As previously reported, NRG no longer reports a Retail segment metric.

Texas: First quarter Adjusted EBITDA was $254 million, $59 million higher than first quarter of 2020. This increase is driven by the acquisition of Direct Energy as well as lower supply costs, partially offset by a reduction of load due to weather.

East: First quarter Adjusted EBITDA was $266 million, $180 million higher than first quarter of 2020. This increase is driven by the acquisition of Direct Energy, prior year write-down of oil inventory by $29 million, and lower plant operating costs.

West/Services/Other: First quarter Adjusted EBITDA was $47 million, $21 million lower than first quarter of 2020. This decrease is due to the receipt of outage insurance proceeds in 2020 of $30 million and lower equity earnings due to the sale of Agua Caliente in February 2021, partially offset by an increase due to the acquisition of Direct Energy.

NRG reported Retail electric volumes as 36 TWh for the first quarter of 2021 (15 TWh residential and 21 TWh C&I).

NRG reported Retail natural gas volumes as 343 MMDth for the first quarter of 2021 (78 MMDth residential and 265 MMDth C&I).

As of May 4, 2021, NRG had $4.1 billion of liquidity available to continue to support its operations.

As of March 31, 2021, NRG cash was at $0.5 billion, and $2.7 billion was available under the Company’s credit facilities. Total liquidity was $3.2 billion, including restricted cash. Overall liquidity as of the end of the first quarter 2021 was approximately $3.8 billion lower than at the end of 2020, driven by the closing of the $3.6 billion Direct Energy acquisition.

NRG noted its previously reported agreement to sell to an affiliate of ArcLight Capital Partners approximately 4,850 MWs of fossil generating assets from its East and West regions (see details here), and said that it is, "Evaluating further valuation accretive streamlining activities."

As previously reported, on January 5, 2021, NRG closed on the Direct Energy acquisition, paying an aggregate purchase price of $3.625 billion in cash, plus an initial purchase price adjustment of $77 million. As part of the acquisition, Direct Energy had cash and margin collateral totaling $385 million. The Company funded the acquisition using $715 million of cash on hand, a $166 million draw on its corporate revolver, and approximately $2.9 billion in newly issued secured and unsecured corporate debt. In addition, the Company increased its collective liquidity and collateral facilities by $3.4 billion. The final purchase price adjustment resulted in a reduction of $38 million and the Company is expecting to receive this payment from Centrica during the second quarter, NRG said

"The Company remains on track to achieve operational and cost synergies of $135 million in 2021 and an annual run-rate of $300 million to be achieved in 2023 by leveraging NRG’s scalable operational platform and best-in-class cost discipline. This includes $51 million from realized synergies in the first quarter of 2021," NRG said

NRG announced the appointment of Alberto Fornaro as Executive Vice President and Chief Financial Officer of the Company, effective June 1, 2021. Fornaro will be succeeding Gaetan Frotte, who has been serving as interim CFO in addition to his responsibilities as SVP and Treasurer since February 4, 2021.

As CFO, Fornaro will lead the entire NRG finance organization including accounting and controllership, financial planning and analysis, tax, investor relations, internal audit, and treasury.

Fornaro had served as Chief Financial Officer of Coupang, Inc. (Coupang) from February 2020 to December 2020 and has been serving as a Senior Advisor since December 2020. Prior to Coupang, he spent almost nine years at International Gaming Technology plc (IGT) from 2011 to January 2020 where he most recently served as Executive Vice President and Chief Financial Officer since 2013. Before IGT, Alberto was Group CFO and President of the Europe, Middle East, and Africa division at Doosan Infracore Construction Equipment. Fornaro also served as General Manager and CFO of Technogym and spent 12 years in finance at CNH Global/Fiat Group in Italy and in the U.S.

NRG announced the designation of Houston, TX as the Company’s sole Corporate Headquarters. "The move to a single headquarters simplifies business operations, as a significant portion of the Company’s employees and customers reside in Texas. NRG will maintain regional offices in the markets that it serves as the Company continues to grow. As the company makes progress against Direct Energy integration milestones, it will continue to evaluate real estate needs and consolidate as appropriate," NRG said

ADVERTISEMENT Copyright 2010-21 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

NRG Names New EVP & CFO

May 6, 2021

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- New Product Strategy and Development Sr. Associate -- Retail Supplier -- DFW

• NEW! -- Sales Development Representative (SDR) -- Houston

• NEW! -- Customer Retention Manager

-- Retail Supplier -- Houston

• NEW! -- Structure & Pricing Analyst -- Retail Supplier -- Texas

• NEW! -- Director, Pricing -- Retail Supplier

• NEW! -- ERCOT Billing Specialist -- Retail Supplier -- Texas

• NEW! -- Senior Analyst - Pricing & Structuring -- Retail Supplier -- Houston

• NEW! -- Sr. Analyst, Structuring -- Retail Supplier

• NEW! -- Account Operations Manager -- Retail Supplier

• NEW! -- Senior Busines Analyst -- Retail Supplier

• NEW! -- Senior Project Manager -- Retail Supplier

• NEW! -- Lead Data Analyst -- Retail Supplier

• NEW! -- Operations Associate -- Retail Supplier

• NEW! -- Pricing Analyst

• NEW! -- Data Operations Analyst

• NEW! -- Chief of the Planning and Procurement Bureau, Illinois Power Agency

• NEW! -- Energy Operations & Reporting Associate

• NEW! -- Commercial Sales Support Representative -- Retail Supplier

• NEW! -- Channel Partner/Channel Sales Manager -- Houston

• NEW! -- Wholesale Originator -- Retail Supplier -- Houston

• NEW! -- Trading Analyst -- Retail Supplier

• NEW! -- Renewables Trader -- Retail Supplier

• NEW! -- Channel Partner Sales Manager -- Retail Supplier

• NEW! -- Experienced Retail Energy Account Manager

• NEW! -- Sales Channel Manager -- Retail Supplier

|

|

|

|