|

|

|

|

|

Texas PUC Staff Discussion Draft Would Require $1.5 Million Letter Of Credit For Mid-Size Retail Electric Providers

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

The Staff of the Public Utility Commission of Texas have filed a discussion draft that would, among other things, modify the current retail electric provider certification requirements

Under the discussion draft, a REP would be required to maintain the financial requirements of subparagraphs (A) or (B) listed below on an ongoing basis.

(A) A REP may maintain an executed version of the commission approved standard form irrevocable guaranty agreement.

(i) The guarantor must be:

(I) One or more affiliates of the REP;

(II) A financial institution with an investment-grade credit rating; or

(III) A provider of wholesale power supply for the REP, or one of such power provider’s affiliates, with whom the REP has executed a power purchase agreement.

(ii) The guarantor must have:

(I) An investment-grade credit rating; or

(II) Tangible net worth greater than or equal to $100 million, a minimum current ratio (defined as current assets divided by current liabilities) of 1.0, and a debt to total capitalization ratio not greater than 0.60, where all calculations exclude unrealized gains and losses resulting from valuing to market the power contracts and financial instruments used as supply hedges to serve load.

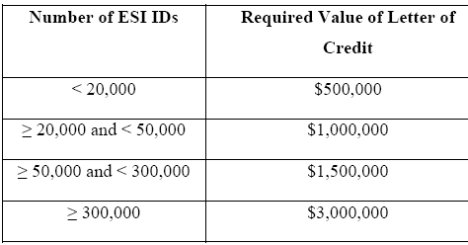

(B) A REP may maintain an irrevocable stand-by letter of credit payable to the commission with a face value as determined in [the chart below] based on the number of electronic service identifiers (ESI IDs) the REP serves. Additionally, for the first 24 months a REP is serving load it must maintain not less than one million dollars in shareholders’ equity.

Among other things, the discussion draft's proposed financial requirements differ from the current rules as follows:

• For the option which does not rely on an irrevocable stand-by letter of credit, the REP would be required to use a third-party guarantor (which may be an affiliate). Currently, a REP may itself meet the requirements by having an investment-grade credit rating or

tangible net worth greater than or equal to $100 million (and other metrics)

• The current level of the stand-by letter of credit for access to capital is a flat $500,000. As noted above, the discussion draft would set this as the minimum level, but would increase the requirement for higher levels of ESI IDs served

Additionally, the discussion draft would require that a REP must maintain, at minimum, protection for all customer prepayments that exceed $50. The escrow account or irrevocable stand-by letter of credit balance must be adjusted, as necessary, at the close of each month to maintain a minimum of 100% coverage of customer prepayment funds exceeding $50. This language varies from the current provision stating that the escrow account or irrevocable stand-by letter of credit must cover 100% of the REP’s outstanding residential advance payments held at the close of each month

In terms of technical and managerial requirements, the discussion draft expands the behavior which disqualifies an individual from controlling a REP

Specifically, in addition to a POLR drop, an individual who exercised direct or indirect control over a market participant that had its ERCOT SFA terminated, or which exited an electricity or gas market with outstanding payment obligations that still remain outstanding at the time of the application, would not be allowed to control a REP, or be used to meet the managerial requirements set forth in the rule.

Furthermore, the POLR drop provision would also now extend to, "a person who was a principal of a REP that experienced a mass transition of the REP’s customers under §25.43 of this title (relating to Provider of Last Resort (POLR)) to the provider of last resort (POLR) at any time within the three months prior to the mass transition." (e.g. including a principal of a REP who left shortly before the POLR drop occurred)

The discussion rule would also require REPs to respond within three working days to any commission staff request for information.

The discussion draft would also impose a reporting obligation on ERCOT and TDUs concerning REP principals as follows: "To the extent an independent organization or TDU is aware that a person who is otherwise barred from exercising direct or indirect control over a REP is acting in violation of this section or other commission rules, the independent organization or TDU has an affirmative duty to report this information to the division of the commission charged with enforcement of the commission’s substantive rules."

Also notable is that the discussion draft would empower Commission Staff to take action to suspend a REPs' certificate in case of bankruptcy or entering a payment plan with ERCOT

Specifically, under the discussion draft, "Commission staff may direct the registration agent to cease processing move-in and switch requests from a REP for any of the following reasons," including that the REP has entered into a payment plan with the applicable independent organization or the REP is engaged in bankruptcy proceedings.

In contrast, current rule allows Staff to file a complaint to seek suspension of a REP, with the REP prohibited from enrolling new customers upon a PUC order, but the discussion draft would grant this authority directly to Staff

Additionally, it has been common in certain bankruptcy proceedings of large REPs (or those of their parent) for the REPs to continue to enroll new customers during restructuring, when DIP financing as been obtained

The discussion draft includes a new definition for principal and makes explicit that, "A principal is a controlling person. A consultant may be a controlling person."

The discussion draft would change the definition of affiliate to reference the definition in §25.5

The draft would also change the time period for REPs to respond to complaints from 21 days to 15 days, including for complaints related to slamming

Project 52796

ADVERTISEMENT Copyright 2010-21 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Draft Includes Changes To Financial, Technical Requirements For REP Certification

April 4, 2022

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! --

Regional Manager: Power Marketing

• NEW! -- Gas Scheduler I - Retail Supplier

• NEW! -- Senior Energy Portfolio Analyst

• NEW! -- Operations Billing Analyst

- Retail Energy

• NEW! -- Head of Operations -- Retail Supplier

• NEW! -- Head of Digital -- Retail Supplier

• NEW! -- Senior Energy Pricing Lead - Retail Energy

• NEW! -- Business Development Manager - ERCOT -- Retail Supplier

• NEW! -- Sales Development Rep

• NEW! -- Structuring Senior Analyst -- Retail Supplier

• NEW! -- National Key Accounts Sales Manager -- Retail Supplier

• NEW! -- Sales Director -- Retail Supplier

• NEW! -- Power Supply Analyst II -- Retail Supplier

• NEW! -- Business Development Manager -- Retail Supplier

• NEW! -- Technical Sales Advisor -- Retail Supplier

• NEW! -- Sales Support Analyst II -- Retail Supplier

• NEW! -- Software Developer -- Retail Supplier

• NEW! -- Gas Scheduler II -- Retail Supplier

• NEW! -- C# Developer -- Retail Supplier

• NEW! -- IT/OT Asset Manager -- Retail Supplier

• NEW! -- Business Development Manager III -- Retail Supplier

• NEW! -- Energy Markets Pricing Analyst

• Energy Pricing Analyst -- Retail Supplier

• Digital Marketing Manager -- Energy Marketer

|

|

|

|