|

|

|

|

|

Illinois Report: ComEd Residential Shopping Customers Paid On Average 1.5¢/kWh More Than Default Service During Past Year

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

Staff of the Illinois Commerce Commission's Office of Retail Market development have filed an annual report on the retail electric market, covering the 12 months ending May 2022.

The report says that, on average on an aggregate basis, residential ARES customers in the ComEd territory paid around $10.16 million more per month during the past twelve months (ending May 2022) when compared to the ComEd Price-to-Compare (PTC) and $9.35 million more per month during the last twelve months when compared to the ComEd PTC including the Purchased Electricity Adjustment (PEA).

In terms of cents per kWh, the report says that residential ARES customers in the ComEd territory paid about 1.662 cents/kWh more when compared to the ComEd PTC only, and about 1.529 cents/kWh more when including the PEA.

In the Ameren Illinois territory, residential ARES customers on average on an aggregate basis paid around $1.97 million more per month during the last twelve months when compared to the Ameren Illinois PTC and $2 million more per month during the last twelve months when compared to the Ameren Illinois PTC including the PEA.

In terms of cents per kWh, residential ARES customers in the Ameren Illinois territory paid about 0.351 cents/kWh more when compared to the Ameren Illinois PTC, and about 0.356 cents/kWh more when including the PEA.

The cost comparison data includes municipal aggregation rates in the ARES data. The vast majority of residential shopping at Ameren is done through opt-out aggregation

"[T]hese numbers are

averages and almost all customers are either below or above the average," the report notes

The report further includes the following notes concerning the cost comparisons:

1. These are total, or aggregate, savings. The savings for almost all individual customers differ from these averages;

2. These calculations are ex-post calculations and do not take into account how the ComEd default rates would have been different had more or fewer customers stayed on the utility’s default supply service;

3. Most of the ARES that serve residential customers have at least one offer that features a renewable energy or "green" component that is higher than what is required under the Illinois Renewable Portfolio Standard. The average rate information collected from the ARES include the (usually higher) prices associated with those offers;

4. Not captured in these numbers are rewards and incentives that are not part of the ARES electric supply rates. For example, several ARES offer one-time gift cards as an incentive to sign up for a particular offer; other offers contain rewards such as airline miles and other non-rate benefits. However, those non-rate benefits are difficult to quantify and include in such calculations. Additionally, Staff would have to make several more assumptions and receive far more additional detailed data from the ARES community to quantify the non-rate benefits offered by

ARES.

ORMD's report included certain individual rate data for suppliers

For the residential market, the lowest rate charged in the Ameren territory for the reporting period was a variable rate product of 3.4 cents per kWh in May 2022. The highest rate charged in the Ameren territory also consists of a variable rate of 21.99 cents per kWh in May 2022. In the ComEd territory, the lowest reported residential rate was 1.14 cents per kWh in June 2021, which was a variable product. The highest rate charged in the ComEd territory was a fixed rate charged from November 2018 through December 2021 of 28.37 cents per kWh. "While none of these rates included additional fees, several suppliers charged separate fees in addition to the reported rates, ranging from $0.19 a day to $15 a month, in the past year. Additionally, several ARES offer subscription or flat fee products pursuant to which customers pay the same monthly amount throughout the life of the contract, which tends to be twelve months. These products ranged from $19 to $389 a month," the report says

During the reporting period, the average rate for a municipal aggregation program in the ComEd territory was 6.202 cents per kWh and 4.498 cents per kWh in the Ameren territory. Consistent with previous reports, the average rate for municipal aggregation programs does not include contracts

with "green" offerings or those offering the same rate as the Price to Compare of their respective electric utility.

As of the end of May 2022,

approximately 1.33 million residential customers were on ARES service statewide, compared to roughly 1.57

million customers in 2021 and over 3 million customers eight years ago. The migration data includes municipal aggregation customers

At ComEd, the number of residential customers served by an ARES was about 747,000 as of May 2022, versus 942,000 a year ago. ComEd residential migration was 20% of customers as of May 2022, versus 26% a year ago

At Ameren, the number of residential customers served by an ARES was about 587,000 as of May 2022, versus 635,000 a year ago. Ameren residential migration was 55% of customers as of May 2022, versus 60% a year ago

Statewide, the share of residential municipal aggregation customers decreased from 57% of all residential ARES customers in

May 2021 to 55% as of May 2022.

Of the 587,466 residential ARES customers in the Ameren Illinois territories, 83% are municipal aggregation customers

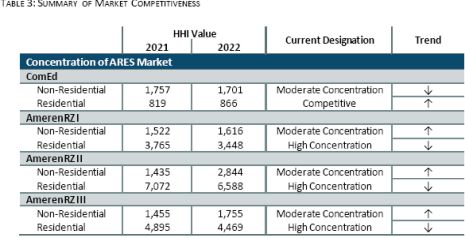

Measured by Herfindahl–Hirschman Index values, the ComEd residential market remains competitive, while all other markets show moderate to high concentration, as shown below

In 2021, only two of the four non-residential markets were moderately concentrated. A year later, in 2022, all four markets are moderately concentrated, showing that the overall retail market was less competitive in 2022 than in the previous year, the report says

In the ComEd residential market, 54 of the 59 ARES with residential customers had a market share of less than 5%. 35 of the ARES with residential customers had a market share of less than 1%. Five suppliers have a market share between 5% and 15%, and no supplier had a market share above 15% in the ComEd residential market

The ComEd residential market saw a decrease, from 69 to 59, in active suppliers as of May 2022 versus the year ago. Additionally, 26 ARES had active ComEd residential offers on PlugIn Illinois for May 2022, versus 36 a year ago.

For the reporting period, the Consumer Services Division of the ICC received between 41 – 89 informal

complaints per month for 21 – 34 ARES, which is down "significantly" from last year where CSD received

67 – 176 complaints per month for 29 – 39 ARES, the report says. These complaint quantities represent 0.003% - 0.006%

of ARES customers per month.

The report does not include any suggestions for administrative or legislative actions

The report notes, "On May 27, 2022, the Governor approved Public Act 102-0958 which amends the Public Utilities Act and the Consumer Fraud and Deceptive Business Practices Act. The Act states that a license to operate for an ARES, AGS, or an ABC is not property, and the granting of a certificate or license does not create property interest. Additionally, the Act aligns the remedies available to a complainant to the Commission, regardless of whether a complaint is brought pursuant to the PUA or the CFA, thus streamlining the enforcement process. The Act also requires ARES and AGS contracts to include an internet address, instead of an email address, to which a consumer complaint may be directed to the Commission under the CFA."

ADVERTISEMENT Copyright 2010-21 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Complaints Against Retail Suppliers Down "Significantly"

July 28, 2022

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Controller for C&I-only Retail Electricity Supplier

• NEW! -- Energy Advisor, PJM -- Retail Supplier

• NEW! -- Senior Retail Transportation Analyst (Gas Transport Services)

• NEW! -- Sales Business Development Manager – Residential Sales

-- Retail Supplier

• NEW! -- Regulatory Affairs Specialist

-- Retail Supplier -- Houston

• NEW! -- Senior Supply & Schedule Analyst

-- Retail Supplier

• NEW! --

Field Analyst I, Sales Quality

-- Retail Supplier

• NEW! --

Regulatory Compliance and Strategy Manager

-- Retail Supplier

• NEW! --

Channel Marketing Strategy Lead

-- Retail Supplier

•

Accounting Manager -- Retail Supplier

•

Business Development Analyst -- Retail Supplier

•

Chief Sales and Marketing Officer -- Retail Supplier

•

Regional Manager: Power Marketing

• Gas Scheduler I - Retail Supplier

|

|

|

|