|

|

|

|

|

State's Energy Procurement Manager Seeks To Reduce Amount Of Forward Hedging Of Electricity Default Service

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

The Illinois Power Agency has filed with the Illinois Commerce Commission a 2023 procurement plan for electricity default service supplies

Generally, the plan follows the current methodology which relies on block energy purchases, up to three years out

However, the IPA does propose a change in hedging at Commonwealth Edison, with reduced forward hedging, due to the new carbon mitigation credits program created by statute.

The IPA said that its energy hedging strategy for the 2023 Procurement Plan is consistent with the strategy used for the

2022 Plan. That strategy involves the procurement of hedges in 2023 to meet a portion of anticipated eligible

retail customer energy supply requirements for a three-year period and includes two block energy

procurement events, one in the Spring and the second in the Fall.

One change that is proposed is to decrease

the amount of summer blocks procured in the prompt Spring procurement by increasing the hedging

percentages for prior procurements.

Additionally, while the

IPA continues utilizing a final hedging level of 100% for Ameren Illinois and MidAmerican (106% for July and

August), the IPA now proposes to hedge to 75% for ComEd in light of the crediting and debiting to eligible retail

customers occurring through carbon mitigation credit (CMC) delivery contract balancing [e.g. state-directed nuclear attribute procurements]

"[T]he hedging approach [at ComEd] will be modified to include consideration of the

offsetting impact that Carbon Mitigation Credits can provide to eligible retail customers by leaving 25% of load

unhedged through IPA procurements.

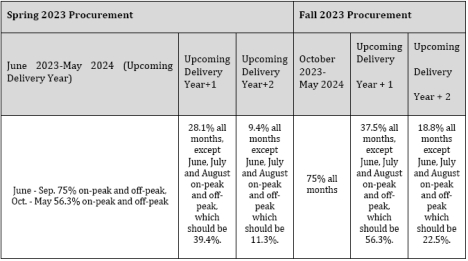

Specifically, the IPA proposes the following energy hedging at ComEd:

"A key consideration for the

determination of CMC payments are the legislated baseline CMC costs set at $30.30/MWh for the 2022-2023 delivery year, $32.50/MWh for the 2023-2024 delivery year, $33.43/MWh for the 2024-2025 delivery year,

$33.50/MWh for the 2025-2026 delivery year, and $34.50/MWh for the 2026-2027 delivery year. The baseline

costs set the limit for CMC price bids. All of the accepted CMC bids were priced at the baseline costs. The day-ahead market price for the relevant month and the value of capacity stated on a $/MWh basis are subtracted

from the CMC bid price to determine the amount to be used in calculating the CMC payment. If the monthly

CMC price calculation results in a net negative value, such as is likely to be the case during periods of high

wholesale electricity prices, the CMC supplier makes payments that benefit all of ComEd’s retail customers.

These payments would help offset the impact of higher wholesale prices on retail customers, including ComEd’s

eligible retail customers," the IPA said

The IPA further said, "the extent to which consideration of CMCs is used to inform the

hedging strategy should reflect the non-delivery and default risks, switching risks, timing issues between the

changes in the PEA and the CMC credit, need for month-over-month rate stability, the potential for overhedging by using the full CMC amount allocable to eligible load in the event that market prices are less that the

CMC baseline cost, and the extent to which forward procurement supply may be priced lower than the actual

delivery month day-ahead price.

While the IPA generally agrees that CMCs can provide a useful price

offsetting mechanism, leaving the bulk of default supply load unhedged by the IPA’s procurements carries

outsized risks along the lines of those outlined above. As a consequence, the IPA believes a more prudent

approach is to balance those risks with CMC hedging benefits."

"In seeking to balance the benefits, costs, and

risks, the IPA proposes for this Plan to procure 75% of ComEd’s eligible customer energy requirements for each

delivery month through the IPA’s block energy procurements with the remaining 25% not covered by IPA

procurements to be procured in the day-ahead market with this uncovered amount in effect hedged by ComEd’s

CMC purchases. The IPA believes this approach best balances rate stability and CMC non-performance risk for

eligible retail customers while also allowing CMCs to serve as an offset for a meaningful portion of default

supply energy procurement," the IPA said

With respect to capacity, the IPA noted that MISO plans to implement a seasonal resource adequacy construct

starting with the 2023-2024 Delivery Year. Under the seasonal resource adequacy construct, capacity in the

MISO Planning Resource Auction (PRA) and in the IPA’s bilateral procurements will be procured for each of

four distinct seasons: summer, fall, winter, and spring.

For Ameren Illinois, for the 2023-2024 Delivery Year the IPA recommends holding a procurement in early 2023

to make up for the capacity not procured in the cancelled Fall 2022 capacity procurement and any additional

capacity that needs to be made up from previously held procurements where Ameren Illinois and the winning

bidders from those procurements cannot come to agreement on how to convert annual ZRCs into seasonal

ZRCs. The target of this procurement is 50% of the forecast capacity needs of Ameren Illinois eligible retail

customers, as was the target in the 2022 Electricity Procurement Plan.

For the 2024-2025 Delivery Year, the IPA recommends continuing the strategy of procuring a portion of

Ameren Illinois’ forecasted capacity requirements in bilateral transactions and the remaining balance through the MISO Planning Resource Auction (PRA).

The IPA is also proposing to increase the amount of capacity it procures in bilateral transactions from 50%

to 75% for the 2024-2025 Delivery Year. For the 2025-2026 Delivery Year, the IPA recommends procuring up

to 25% of its forecasted capacity requirements in bilateral transactions in 2023, with the balance of forecast

capacity requirement to be determined in the 2024 Electricity Procurement Plan.

ICC Docket 22-0590

ADVERTISEMENT ADVERTISEMENT Copyright 2010-22 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

September 30, 2022

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Sales Development Representative

• NEW! -- Operations Analyst/Manager - Retail Supplier

• NEW! -- Customer Success

• NEW! -- Market Operations Analyst

• NEW! -- Operations Manager - Retail Supplier

• NEW! -- Marketing Associate - Retail Supplier

• NEW! -- Supervisor-Commercial Operations

• NEW! -- Customer Data Specialist

• NEW! -- Director, Regulatory Affairs, Retail Supplier

• NEW! -- Account Manager Project Manager

• NEW! -- Retail Energy Policy Analyst

• NEW! -- Incentive Specialists

• NEW! -- Utility Rates Specialist

• NEW! -- Customer Onboarding Specialist

• NEW! -- Energy Performance Engineer

|

|

|

|