|

|

|

|

|

Report: Load Serving Entity Obligation Would, "Significantly Strain The Competitive Retail Market," In ERCOT

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

The Consumer Fund of Texas has filed with the Texas PUC an Assessment of ERCOT Market Structural Changes, prepared for the group by ICF Resources, LLC

The report examines three policies: the Load-Serving Entity Obligation (LSEO); the Dispatchable Energy Credits (DEC) proposal and a Backstop Reliability Service (BRS) proposal

As described by the report, the LSEO seeks to address future resource adequacy challenges by obligating all ERCOT load-serving entities (LSEs such as competitive retail electric providers and municipal and electric cooperatives) to acquire enough firm future resources to cover their share of future demand levels, or pay a penalty for the failure to acquire sufficient forward capacity. The LSEO is comparable to Resource Adequacy (RA) constructs in markets such as MISO, SPP, and CAISO.

As described by the report, the DEC is based on the concept of Renewable Energy Credits. The DEC proposal would mandate that retail LSEs procure a specified amount of dispatchable energy credits (DECs) every year or pay a shortage price. DECs would be granted to each MWh produced by 2-hr batteries and highly efficient, quick-start thermal resources that produce according to specified fast-start, fast-ramp conditions. Administratively determined assignment of DEC purchase and retirement obligations would be indexed to each load-serving entity’s share of retail load. In contrast to the LSEO, which focuses on systemwide capacity, the DEC program is designed to incentivize a narrow set of highly flexible, quick-start resources and is intended to improve the grid’s flexibility and responsiveness to short-duration needs

As described by the report, the Backstop Reliability Service (BRS) is designed and modeled as a tool to prevent units that would otherwise retire from actually going offline, by paying each unit’s going-forward fixed and operational costs to enable them to remain available and functional in case of emergency. Every unit that goes into the BRS program is assumed to be allowed and expected to operate only under emergency conditions and is prevented from operating in the day-to-day ERCOT energy market. Additionally, by program design, wholesale spot market prices should be unaffected by BRS-unit dispatch during system emergencies. Therefore, with a BRS program ERCOT energy market prices should be identical to prices prevailing in a case where the units retire, the report states.

"This BRS framing contrasts to other backstop service designs, including one that removes existing units economically from the market to create “artificial scarcity” and an alternative that would grant state contracts to firms such as Berkshire or Starwood to build new units to be used solely for emergencies without any opportunity to compete in the energy market. The BRS program evaluated herein does not provide incentives to any new generation," the report states

The report compares outcomes versus present policy ("Phase 1") and against each other going forward (Phase 2)

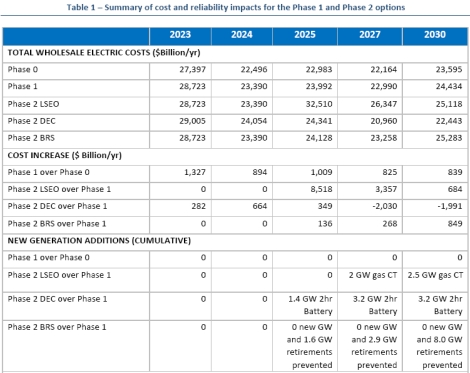

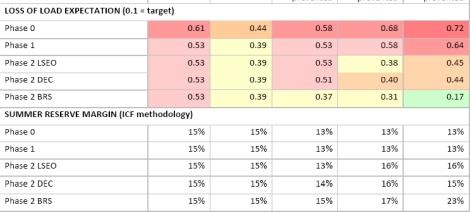

The report summarized its finding with respect to total costs, new generation, loss of load expectations, and reserve margin in the table below (page 17 of the report, linked below)

The report concludes that, "The LSEO

proposal offers the highest forecasted cost impact while delivering the least reliability improvements."

The report states, "If the market is very short of capacity under the LSEO, there is a large risk that costs could be extremely

high - potentially doubling compared to Phase 1 - especially in the first year of implementation

(whether 2025, 2026 or later)."

The report states, "The LSEO would significantly strain the competitive retail market."

"Other U.S. power markets with a

resource adequacy construct (such as MISO, SPP, and CAISO) are dominated by regulated utilities and

allow limited or zero retail choice," the report states

The report states, "The short-term nature of likely capacity contracts under the LSEO means financing new resources will

not be much easier than under Phase 1 unless contract prices are very high, limiting program impact

on reliability."

The report states, "The ERCOT market is already designed to raise wholesale electric prices when generation supplies are tight in

order to incentivize capacity and availability. The LSEO proposal would provide extra compensation to

generators ahead of time in addition to the existing incentive structures, creating a double payment. This

premium could kick in as early as 2025, raising wholesale electric prices by a forecasted $8.5 billion - an

increase of 35% over the costs of the Phase 1 market in a single year. LSEO costs could lower and stabilize in

later years, but the forward payments to generators that begin in 2025 will not yield any additional new gas

plants until the 2026-2027 timeframe and would not keep old gas or coal plants from retiring. Over 2025-

2030, on average the LSEO would increase market costs by approximately $3.8 billion per year. Critically, there

are many uncertainties in the LSEO program design that could yield lower or significantly higher costs than this

projection."

The report states that, ""[G]enerators' aggregate earnings increase significantly under

the LSEO, decrease under the DEC, and are unchanged under the BRS compared to Phase 1."

The report concludes, "The LSEO would likely cost consumers $8.5 billion in the year 2025 alone, and $22.5 billion from 2025-2030 in total. We forecast LSEO to bring online 2.5 GW of additional gas generation by 2030 compared to Phase 1."

The report concludes, "The DEC proposal would cost consumers $1.3b total over the first three years (2023-2025), but then actually reduce the total costs to consumers by approximately $2b each year from 2027-2030. We forecast DEC to bring online 3.4 GW of additional 2-hour battery storage by 2030 compared to Phase 1."

The report concludes, "The BRS would cost $838 million in its highest year (2030) and a total of $2.6 billion from 2025-2030, 90% less than the LSEO with far greater reliability benefits. We forecast BRS to preserve 8.0 GW of capacity that would otherwise retire by 2030 under Phase 1."

With respect to the other options, the report states that, "Wholesale costs are net negative under the

DEC while improving reliability."

The report states, "One concern with DEC is that it creates additional payments for a small subset of (mostly new) resources, which suppresses market energy prices and could prompt accelerated, additional retirements (although our study does not forecast this in the Base Case)."

The report states, "The BRS program in contrast has modest costs, on average increasing total market costs by about 2% over

2025-2030 (growing from $135MM in 2025 to $858MM in 2030, averaging $428 million per year). BRS costs

are much smaller than the LSEO because the BRS is not a market-wide mechanism and targets payments to a

limited subset of capacity, that is, resources that would otherwise retire but are instead kept operational and

deployed only during emergency conditions. Critically, wholesale market prices would not be affected by the

availability or operation of BRS-contracted units."

"Like the BRS, the DEC program adds a new payment stream to a limited subset of resources - specifically, fast

and flexible resources needed to stabilize supply particularly during solar and wind ramps and sudden

generation or transmission losses. Unlike the BRS, units receiving DEC payments do participate in the

wholesale market and affect market prices. Because the DEC incentives are forecasted to bring new storage

and fast-responding generation capacity online, market prices will drop (especially scarcity prices) over time.

On net, the DEC program therefore has negative total costs (i.e., it will deliver cost savings for consumers).

These cost savings come about through reduced payments to generators in aggregate, which might be

inconsistent with the PUCT goals for ERCOT market redesign," the report states

Link to report

Projects 52373, 53298

ADVERTISEMENT ADVERTISEMENT Copyright 2010-22 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Load Serving Entity Obligation Has Highest Cost, Least Reliability Benefits, Report Says

October 26, 2022

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Accounting Manager -- Retail Supplier

• NEW! -- Market Operations Analyst -- Retail Supplier

• NEW! -- Sales Development Representative

• NEW! -- Operations Analyst/Manager - Retail Supplier

• NEW! -- Customer Success

• NEW! -- Operations Manager - Retail Supplier

• NEW! -- Marketing Associate - Retail Supplier

• NEW! -- Supervisor-Commercial Operations

• NEW! -- Market Operations Analyst

• NEW! -- Customer Data Specialist

• NEW! -- Director, Regulatory Affairs, Retail Supplier

• NEW! -- Account Manager Project Manager

• NEW! -- Retail Energy Policy Analyst

• NEW! -- Incentive Specialists

• NEW! -- Utility Rates Specialist

• NEW! -- Customer Onboarding Specialist

• NEW! -- Energy Performance Engineer

|

|

|

|