|

|

|

|

|

Working Group Seeks One-Year Delay In Supplier Consolidated Billing

The following story is brought free of charge to readers by VertexOne, the exclusive EDI provider of EnergyChoiceMatters.com

The Supplier Consolidated Billing (SCB) Work Group (WG) in Maryland has filed a report stating that, "an extension of the implementation schedule for SCB implementation in 2024 for all utilities is likely required."

The SCB WG report requested that the PSC, "approve an extension of SCB implementation into 2024."

Currently, SCB is scheduled to be implemented by the end of December 2023

The WG report also sought PSC guidance on cost recovery for SCB and parties could not reach consensus.

The WG report notes that, in addition to other pressures which likely necessitate a delay, utility expenditures on SCB may need to be halted pending a decision on the cost recovery method to prevent additional sunk costs if supplier participation in SCB is not expected due to the chosen recovery method. There are a multitude of proposals, ranging from cost recovery from ratepayers, to recovery from suppliers through various means: upfront payments, a discount or ongoing fee to SCB suppliers, or using UCB discounts to pay for SCB. Suppliers have said that upfront cost recovery from suppliers in several proposed amounts would chill SCB participation

Concerning the SCB implementation schedule, the WG report said, "Staff notes that the utilities have expressed concern regarding the current schedule for the implementation of SCB. Both PE and WGL have indicated that they would likely need until the end of 2024 to implement SCB. BGE and PHI have indicated that they do not believe an end of 2023 as scheduled is possible due to the slow progress made in the EDI work group and no commitment from a supplier to implement SCB for testing purposes. The Exelon utilities have not provided an estimated time frame revision, but would like flexibility to implement in December 2024 subject to optimizing an effective date that minimizes costs. Staff and the Exelon Utilities are in discussion to develop a firmer commitment and estimated cost of an extension that is contingent upon an EDI finalization date. Any start date is contingent upon a supplier being available to test their systems with a utility."

"Currently the XML workgroup has finalized the transactions that they intend to utilize between suppliers and utilities. The final steps are for a formal Maryland XML Work Group review to be followed by a filing with the Commission for final approval. WGL has indicated that once the transactions are approved by the Commission, they intend to issue a RFP to develop their SCB program. BGE has indicated that they have some concerns finalizing XML transactions before the EDI transactions are considered final, in case there are cross-over implications to BGE gas," the WG report notes

"The EDI technical workgroup is still developing EDI standards. The SCB EDI WG was meeting bi-weekly from June 2022 - December 2022, at which time the SCB EDI WG started to meet weekly. The SCB EDI WG has started meeting twice a week to speed up finalization of EDI transactions," the WG report notes

"There has not been agreement reached yet as to an appropriate extension to finalize SCB development, but, the slow progress in the EDI subgroup likely necessitates a 2024 start date. As noted above the utilities would like the flexibility and authorization to fully implement SCB by the end of 2024," the WG report said

Concerning cost recovery, the latest costs for SCB implementation are as follows:

"The parties disagree as to the appropriate way to recover these funds, which range from total ratepayer recovery to total SCB customer recovery. This petition seeks the Commission’s determination on cost recovery and the framework by which the Commission would direct that the cost of SCB be recovered," the WG report said

"To prevent any further sunk costs, it may be necessary to suspend utility development of the SCB functionality until a clear decision on cost recovery has been made. One of the most significant uncertainties is customer and supplier participation within the SCB programs, such that it may be untenable to expect full cost recovery solely from SCB suppliers in a timely manner, especially at the cost levels forecasted by the utilities," the WG report said

Notable among the options for cost recovery is a mechanism under which some or all of the costs are recovered from all suppliers participating in utility consolidated billing, via a discount similar to POR, even if the supplier utilizes only UCB, and not SCB (Option 2)

The WG report notes that, "Under this method, suppliers who do not utilize SCB pay for the program though they may not

directly benefit."

Suppliers have raised concerns with proposals requiring an upfront cost for SCB suppliers, either through a discount or flat per-SCB-customer charge.

If the "day one" SCB participation is 5% of choice customers, the per-customer charge to suppliers would be at least $10 (up to $104 at PE), while an SCB discount would be at least 10% (over 100% at PE)

Suppliers have said such level of fees would prevent them from participating in the SCB program.

The WG notes that such fees for SCB may incentivize suppliers to use UCB, leaving SCB unused.

Another notable proposal is a PSC Staff compromise proposal (Option 4)

Of the Staff compromise proposal, the WG report says, "As shown in the previous section, at current cost estimates requiring SCB suppliers to pay 100% of the implementation costs is likely unaffordable to suppliers and may jeopardize timely cost recovery. Yet, non-supply parties believe that cost recovery from ratepayers or UCB does not follow cost causation and that SCB suppliers are the driver of costs and will be the ultimate beneficiaries. Therefore, Staff’s proposal requires a commitment from the suppliers to pay for a portion of SCB costs to utilize the program. Staff’s proposal attempts to avoid creating market incentives that offer preference to the UCB market over the SCB. A successful SCB program will only be possible if suppliers do not have an incentive to stay only in the UCB markets. One incentive to stay in the UCB markets until the SCB markets are more mature is the payment of SCB costs. Therefore, Staff’s proposal has suppliers that plan to participate in both the SCB and UCB markets pay for the SCB program."

"Staff proposed, based on the suppliers currently participating in the SCB WG, that the suppliers who plan to participate in the SCB markets commit to paying at least 50 - 55 percent of total SCB implementation costs. These suppliers include the original Petitioners, Constellation, WGL Energy, SFE Energy, and DECA. These upfront costs would be backed by some form of guarantee that is enforceable to pay for at least 50 percent of costs. These forms of guarantee could include contractual guarantees, bonds, letters of credit, and similar instruments. In its proposal, Staff did not indicate how individual suppliers who are part of this group pay the initial costs but believes a scaling $/per customer across all their subsidiaries in SCB and UCB is appropriate to ensure small suppliers are not disadvantaged as compared with larger suppliers. The costs could be paid upfront or over 5 years subject to carrying charges," the WG report notes

"To disincentivize a supplier from joining the SCB markets to avoid the upfront commitment in year one, Staff proposed that suppliers who join the SCB market pay a minimum amount and then

pay an ongoing $ per bill fee that ensures the supplier does not pay less than those who originally

committed to the program. These $ per bill fees would continue until the other 50 percent of the

costs were repaid to ratepayers. Meanwhile, the other 50 percent of SCB costs will be paid by

ratepayers who are then paid back by new SCB market supplier participants if the SCB market

matures," the WG report notes

"Staff’s proposal is structured so that supplier participants in the SCB markets guarantee at least 50

percent of the costs are covered by choice participants. Additionally, if the SCB market is

successful, Staff’s proposal creates a path for full cost recovery from SCB suppliers where

additional revenues collected from suppliers after full rate recovery will be returned to ratepayers," the WG report states

"Suppliers in the SCB WG countered that Staff's proposal creates an unreasonable and prohibitive

barrier to participating in the SCB program. Suppliers’ position is that, under Staff’s proposal,

they cannot formulate reasonable business plans that support participation in the SCB program.

This is because Staff’s proposal requires a potential six or seven figure upfront dollar commitment,

e.g. a price of admission, on top of their own SCB costs, and a years-long financial commitment

in each service territory. This may limit supplier participation, along with the issues discussed

above that suppliers: (1) potentially unknown or low participation initially to ensure a smooth

transition and changing market dynamics; (2) do not know and cannot control the utilities’ costs;

(3) cannot confidently predict when the SCB program will begin given the utilities’ representations

that more extensions are needed, nor can they predict the market conditions when the program

begins. Additionally, Suppliers are also concerned the proposal would give free ridership to SCB

participants who come in after the initial five-year period," the WG report states

"If the Commission wishes to pursue this option {Staff compromise] or a modified version of a guarantee, the Commission may need to direct a halt in SCB system development until such an agreement is reached. A delay in development until a cost guarantee is given is complicated, as arguably, the Commission found that SCB is authorized by the original Customer Choice Act. PE points out that authorizing SCB does not equate with mandating it go forward regardless of cost or who is willing to pay those costs. The Commission could find that until some forms of guarantees are given there is not sufficient interest to implement SCB because the costs outweigh the perceived benefits. From a practical manner if SCB system development is halted this may lead to a sunk cost of about $8.3 million which may increase until a decision is made," the WG report states

Other proposals include having ratepayers initially pay all (or part) of SCB costs, with SCB -- or UCB -- suppliers paying back the costs over time. The WG reports that making ratepayers whole under these options is dependent on SCB participation (unless UCB is used)

"A modified version of this could be using UCB instead of the ratepayer as the original funding

source. This modified option was never discussed with the workgroup," the WG report notes

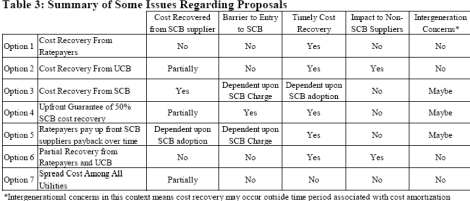

A table summarizing the various recovery options considered is below:

The WG asked the Commission to determine the appropriate method or to limit the issues related to cost recovery methodology of SCB costs.

On a separate issue, the WG asked the PSC to approve the utilization of the low-income customer definition approved in RM78 for SCB using one of the two methods described in the report

Case No. 9461

ADVERTISEMENT ADVERTISEMENT Copyright 2010-23 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Working Group Seeks PSC Guidance On Cost Recovery

March 20, 2023

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

BGE: $11.3 million

PHI: $9.7 million

PE: $7.3 million

WGL: $4 million

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Channel Sales Manager -- Retail Supplier

• NEW! -- Business Development Manager

• NEW! -- Operations Manager/Director -- Retail Supplier -- Texas

• Senior Scheduler -- Retail Supplier

• Channel Sales Manager -- Retail Supplier (Houston)

|

|

|

|