|

|

|

|

|

ESCOs File Proposed Mechanisms For Disclosure Of Broker Fees In New York

The following story is brought free of charge to readers by VertexOne, the exclusive EDI provider of EnergyChoiceMatters.com

Stakeholders have provided comments on a New York Department of Public Service Staff proposal for changes to the uniform business practices to implement New York's recently passed law which imposes new regulations on brokers and consultants, including a registration requirement, financial surety requirements, and requirements concerning compensation disclosure

See background on the new law and Staff's implementation proposal here

As previously reported, PSL §66-t(4) requires energy brokers and energy consultants to disclose their form and amount of compensation to customers via a conspicuous statement on any contract or agreement between the energy agent, consultant, broker, or intermediary and its customer.

"Staff recommends that if an ESCO or DER supplier collects broker compensation on behalf of the broker or consultant, such compensation shall be added to the Customer Disclosure Statement in the ESCO or DER supplier’s customer agreement and reflect the amount and method. To the extent there are caps or limits on the price ESCOs or DER suppliers may charge for any certain product, Staff believes that those pricing restrictions must continue to be observed, inclusive of any and all fees, including but not limited to energy broker or consultant compensation," Staff has proposed

Staff recommended that all such disclosures of compensation to customers include any dollar amount paid to the broker or consultant, the form in which the compensation was given to the broker or consultant, the entity that made the payment, and any broker fee or margin that was added to the energy supplier’s rate. Staff further recommended that this financial disclosure include anything of value that was given as compensation to the energy broker or consultant for its work, including commissions, bonuses, and any non-financial compensation. Additionally, Staff recommended that this statement be made in plain language and appear in 12-point font size or larger.

Several ESCOs and brokers have filed proposals and/or comments in response to the Staff recommendation

NRG Energy said that the fee disclosure should be standardized

NRG said, "It is imperative ... that the

disclosure be standardized and uniform so that every ESCO is showing this fee the same way."

"Allowing different interpretations of the disclosure may result in some Energy Brokers or Energy

Consultants having a competitive advantage over others. It could also create a competitive

advantage for certain ESCOs if they elect to employ vague disclosures or those that do not

accurately capture the true amount and method of the broker compensation," NRG said

"Having one standardized way in which this fee must appear on the Customer Disclosure Statement will

enable more customer transparency," NRG said

NRG Energy recommends spelling out how the amount of the fee must be disclosed so

that all customer agreements are displaying the fees the same way.

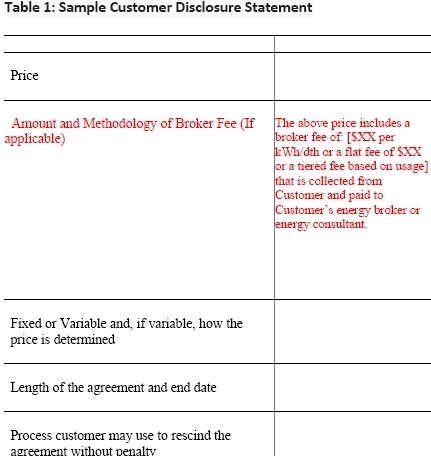

As shown in a table recommended by NRG shown below, NRG Energy suggests adding another row to the Customer

Disclosure Statement under the Price. This row would be entitled "Amount and Methodology of

Broker Fee" and need only appear if the customer used an Energy Broker or Energy Consultant

to broker the customer agreement and if the compensation is being paid by the customer to the

Energy Broker or Energy Consultant via the ESCO charges, NRG said. The field would show either the dollar

per kWh or dth or MMBTU that the customer is paying for the Energy Broker or Energy Consultant

to handle the account. If the Energy Broker or Energy Consultant is getting paid a flat fee, the box

should reflect the dollar amount of that fee. Lastly, if the compensation structure is one that is

based on a tiered usage structure, that tiered structure should be spelled out in the label so that

customer can understand exactly what they are paying, NRG said

"Allowing each individual company to

adapt its own interpretation will result in customer confusion and unintended market

advantages," NRG said

NRG's recommended change to disclosure statement:

In separate comments, Family Energy made several observations about the Staff compensation disclosure proposal.

Family Energy said that a new field should be added to UBP Section 5, Attachment 4 – Sample Customer Disclosure Statement, for "broker compensation".

Family Energy further said, "Second, in the case of the ESCO in-house sales team that is acting on behalf of the ESCO, no compensation disclosure for sales team members should be required. To require such a disclosure would be tantamount to requiring disclosure of employee salaries, which is not within the statutory language or scope of PSL 66-t. In fact, the in-house sales team is not a 'broker' or a 'consultant' within the statutory definition as it is not acting as an intermediary to the transaction. The in-house sales team is the ESCO in the customer transaction. Moreover, one of the principal reasons for requiring broker compensation disclosure is the need for increased transparency to consumers about the relative 'allegiance' of the salesperson. That a broker or consultant was acting as an intermediary to the transaction and getting compensated for that role may not have been historically clear or obvious to the consumer. In the case of an in-house sales team member, there can be no question on the part of the consumer that the salesperson is directly acting as the ESCO for the purpose of making the sale."

Family Energy's point here was more broadly raised by several ESCOs who sought confirmation that the new proposals, as its provisions relate to brokers (and not specific ESCO obligations, such as compensation disclosure or reviewing that a broker is registered with the PSC), will not apply to ESCO marketing representatives who are acting on behalf of the ESCO (whether ESCO employees or a vendor retained by the ESCO), since such marketing is already addressed under various other PSC rules

Family Energy further said that the commission disclosure should only occur on non-residential sale, because, for residential sales, the compensation under the predominant forms of customer acquisition does not constitute "broker compensation" under the statutory definition, as Family Energy explains below

Family Energy said, "Third, the implementation of the law requirement for ESCO disclosure of the 'amount and method of broker compensation,' should properly reflect the term 'broker compensation' as defined in PSL § 66-t as well as how broker compensation is handled in practice, which is highly customized to each broker and transaction."

Family Energy said, "Commissions for commercial customer enrollments are generally paid as a function of a mill adder multiplied by customer usage over the life of the retail energy supply agreement. As such, a commercial commission falls directly within the statutory definition of 'broker compensation' because it is paid for the purpose of 'securing or procuring of energy for the end-use customer,' and the ESCO is collecting the broker compensation on the entity’s behalf through the customer bill. The commission is a component of the commodity supply rate agreed to by the customer, and is a direct cost to the customer. The customer has an interest in understanding that the commission is being paid as a part of the contracted supply rate."

Family Energy said, "There are, however, a number of varying factors impacting commercial commission payments. A customer’s actual usage is not known at the time the agreement is signed. The compensation payment may be received upfront, over a period of months, or a hybrid approach. Other factors impacting the compensation could be the size of the commercial customer and renewal rates. The commission rate paid is highly customized between the entity and the ESCO. These factors would make it unworkable to require disclosure of a specific overall dollar amount of commission at the time of contracting. Indeed, even the per mill figure is customized for each entity, making its inclusion on an ESCO disclosure document on a standardized basis difficult with respect to a commercial customer."

Family Energy said, "For a residential customer, the residential commission understood in its most basic form is as a customer acquisition cost to the supplier, not a payment made to the intermediary for 'securing or procuring of energy for the end-use consumer' under the statutory definition of 'broker compensation.' Unlike commercial customer enrollment commissions (which are a direct cost to the customer), residential enrollment commissions are a direct cost to the supplier of utilizing the door-to-door sales or telemarketing vendor. The rate of compensation for residential customer enrollments is also highly customized to each vendor and is generally expressed as a fixed rate per enrollment. However, while the commercial customer commission rate is collected for the intermediary as a function of the ESCO supply rate on the customer bill, the residential customer commission rate is not an identifiable, unbundled component of the customer’s commodity supply rate and is collected as a function of the ESCO’s overall cost of doing business. This distinction is important as it goes to the heart of the rationale for providing increased customer disclosures. The commercial adder commission is a direct part of the contracted supply rate paid on the bill for 'securing and procuring of energy,' that the commercial customer should understand. For a residential customer, the rate paid to the vendor is not directly part of the supply rate, and it cannot be unbundled and expressed as an amount per energy unit (i.e., mills/kWh or mills/therm) component piece of that supply rate. Nor would its disclosure benefit the residential customer any more than describing all the myriad other costs incurred by the ESCO to offer a retail commodity product. It is part of the ESCO’s cost of customer acquisition and is not paid for 'securing or procuring of energy' for the consumer. The ESCO is not collecting the residential commission on the vendor’s behalf through the residential customer bill. Therefore, it is not 'broker compensation' under the statutory definition."

Family Energy said, "In view of the foregoing, Family Energy proposes the following with respect to compensation disclosure requirements. For commercial customers, ESCOs should include a general statement on the Customer Disclosure Label to the effect that the ESCO is collecting compensation on the broker or consultant’s behalf that consists of a mill adder charge in the supply rate that is applied to the customer’s actual usage over the term of the agreement. In this way, the amount and method will have been disclosed by the ESCO to the extent possible at the time of contracting."

Family Energy said, "For residential customers, no disclosure should be required because the commissions paid for acquisition of residential customers are not 'broker compensation' under the statutory definition. In addition, with respect to the residential customer enrollment commission, the ESCO is not collecting the commission from the customer on the vendor’s behalf through the billed commodity rate. The ESCO pays the vendor the commission directly on its own account."

Power Management Co., LLC (PMC) said that if disclosure is required, it should be on a unit basis only

PMC said, "PMC would modify Staff’s recommendations on how the fee should be disclosed. The law

describes that disclosure as both 'form and amount' and 'amount and method'. Staff

recommends that disclosure include 'dollar amount paid' and any 'broker fee or margin' added

to ESCO’s rate. If disclosure is required, PMC believes that only factual and memorialized

methods/forms and amounts should be disclosed (i.e., unit fee added to ESCO rate) in keeping

with the description in the law. This clearly meets the definition of form/method and amount

specified within the regulation."

PMC further said, "Estimates of dollar amounts that may or may not be paid overtime should not be disclosed as

they cannot be calculated at the time of contract and would not be accurate or correct. In other

words, brokers/consultants in these transactions typically would be paid based on a fee per unit

of the energy. This unit fee would be applied to energy consumed in the future and eventually

paid for by our clients on a time-extended trailing basis. That is, as future volumes change due to

operational changes, weather, regulatory programs (i.e., ReChargeNY), sale of all or part of

business, etc., or if the customer does not pay for the energy used over the term of the contract,

then compensation dollars change drastically, or may not be paid at all. Therefore, disclosure of

the estimated calculation of dollars to be paid in the future over-time based on consumption

fluctuations or payments, etc. would not be accurate, reasonable or an acceptable representation

of compensation. PSC Staff further recommends that direct contractual relationships with clients

be regulated as to set forth the form to include specific requirements for fee disclosure. They

have also requested that these agreements be approved in advance by Staff. This requirement

intends to regulate a private transaction that is completely unnecessary. No C&I client would

agree to engage with PMC (or any other entity) without adequate fee disclosure and scope

descriptions within the agreement. For Mass Market customers (residential or small commercial),

perhaps some disclosure requirements are necessary to protect residential or very small

commercial customers but direct contractual relationships with this very small class of client

really do not exist or are rare at best."

PMC said that the Staff recommended disclosures "reduces competitiveness"

"PMC believes that the requirement to disclose compensation creates an unfair and un-equitable

treatment between directly competing energy supply services businesses (i.e.,

brokers/consultants, ESCO’s and others)," PMC said

"PMC’s disclosure concerns center on the idea that fee disclosure is

being required for brokers/consultants, but not required for ESCO’s, creating an uneven and

clearly disadvantageous competitive environment for brokers/consultants which compete every

day with ESCO’s (and other businesses meeting the same definition) for the same business.

Important to this discussion is the fact that energy brokers/consultants are the engine that drives

the competitive energy environment in New York State and all other states. ESCO’s are similarly important but only provide customers single biased options to competitive energy supply.

Brokers/consultants like PMC bring these options together for our customers to create that

competitive environment for the energy consuming public therefore creating market awareness

and liquidity," PMC said

PMC said, "Each ESCO or energy supplier has their own internal direct sales and support functions that

compete directly against brokers/consultants every day for the exact same business. For clarity,

everyday, ESCO’s perform the same function as and completely and fully meet PSC staff’s

definition of 'energy consultant'. Like PMC, ESCO’s solicit, negotiate, advise, counsel and

accept contracts for electric and natural gas service competing for the same customers. Staff has

rightly concluded that ESCO’s and others likely meet the definition. If brokers/consultants are

required to disclose compensation, then ESCO’s performing the same function and competing

for the same business should be made to similarly disclose compensation. Note that the

brokers’/consultants’ fees required to be disclosed as described represent 100% of all income

derived for the sales, support, ongoing management and overhead needed to provide our energy

services. This fee is not our margin, which would be substantially less than total income. PMC,

like any commercial business, is extremely sensitive about disclosing total income as this

information is competitively proprietary and confidential to providing our high level of expertise

and service in the category and another justification for the objection to this requirement.

However, if we are required to disclose this information, then all like (by definition) and

competing entities should be made to make the exact same disclosures on the same basis of

services provided and supported by those fees. If brokers/consultants are made to disclose

compensation and competitors (ESCO’s) are not, then PMC is being clearly placed at a

competitive disadvantage that should not be allowed. Note that this disadvantage to

brokers/consultants will quite definitely and negatively affect the competitive nature of deregulation in NY. If disclosure is required of brokers/consultants, then the Commission should

use its existing authority to require the same level of disclosure from ESCO’s to ensure a level

and competitive energy marketplace."

Several brokers raised concern about Staff's proposed deadline for brokers to be registered by August 31, 2023 (which contemplates about 60 days from a final order adopting the broker requirements if an order is issued by a statutory deadline of June 21, 2023.)

Aurora Energy Advisors, LLC said, "The proposed 60-day time period for the submission of registration applications is very

constrained and, hence, there is a possibility that Staff will not have sufficient time to process all

applications and respond to each with an affirmative decision before August 31, 2023. For

example, if an energy consultant has filed a complete registration application by July 1, 2023,

that complies with all registration requirements but has not received a determination from Staff

by August 31, 2023, what conclusion should the energy consultant draw? Is the consultant

deemed properly registered on the filing submission date of July 1, 2023, or August 31, 2023, in

this example? Should the energy consultant be deemed 'not registered' up until the time that

Staff has responded to the application?"

Aurora Energy Advisors further asked, "Additionally, the Staff Proposal requires Energy Service Companies ('ESCOs') to verify

that any broker or consultant working on its behalf is properly registered with the NYPSC and

urges ESCOs to perform regular reviews to ensure the registrations of such brokers or

consultants remain valid. If a timely submitted application is not yet approved by Staff , [sic] can an

ESCO withhold payment to a broker or consultant on the basis that the broker or consultant is

not 'registered'?"

L5E, LLC separately said that the PSC should clarify that any broker that has

timely filed for registration in New York shall be permitted to continue to operate in the State

pending approval or rejection of its application by the Commission.

Several ESCO raised concerns with their ongoing obligation to ensure they work only with registered brokers. Several ESCOs asked the PSC to confirm that, in situations where a broker is no longer registered with the PSC, this does not require the abrogation of any prior customer contract among the supplier, broker, and customer

Aurora Energy Advisors, LLC also raised concern with Staff's proposed requirement that brokers use a irrevocable standby letter of credit to meet the statutory financial fitness standard of $100,000 for brokers and $50,000 for consultants

Aurora Energy Advisors said, "Because a LOC is challenging and expensive to obtain, Aurora recommends that the Staff

Proposal for a $50,000 LOC be replaced with a requirement for a surety bond of $50,000 or proof

of financial accountability through the presentation of a financial statement showing net assets of

the consultant of at least $50,000. Aurora would recommend similar flexibility for energy brokers.

In light of the current economic and banking climate, the requirement to post an LOC of

$100,000 for brokers and $50,000 for consultants presents an economic challenge. Finding

suitable issuers is more difficult and issuance requirements are more stringent and expensive.

Aurora encourages the Commission to implement flexible a requirement that would assist energy

management firms of all sizes in maintaining their businesses. Currently, other states permit

surety bonds for brokers and consultants as a demonstration of financial accountability. For

instance, Illinois requires brokers and consultants to provide a surety bond in the amount of

$5,000. Alternatively, Aurora encourages the Commission to consider an annual financial

statement as proof of financial fitness. This alternative would facilitate licensure for smaller

energy management operations that may otherwise have difficulty securing a surety bond or

LOC."

With respect to data security, the joint utilities said that energy brokers and energy consultants

should be held to the same standards as ESCOs, DERS, and other third parties to whom the Commission

requires that utilities provide customer data.

"To that end, the New York Utilities

recommend that the Commission make clear that 'data security requirements' include not only

processes and procedures for energy brokers and energy consultants to secure customer data, but

also their compliance with applicable utility requirements before they receive customer data.

These related requirements may include that energy brokers and energy consultants enter into

data security agreements (DSAs) with the utilities and complete the accompanying self-attestations before receiving customer data," the utilities said

ADVERTISEMENT ADVERTISEMENT Copyright 2010-23 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Standardized Format For Compensation Disclosure Proposed; One ESCO Says Fee Disclosure Not Applicable For Residential Customers

Broker Says Disclosure Reduces Competitiveness, Says ESCOs, "Only Provide Customers Single Biased Options To Competitive Energy Supply"

Utilities Seek To Apply ESCO Data Security Requirements To Brokers

May 22, 2023

Email This Story

Copyright 2010-23 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Sales Support Specialist

-- Retail Supplier

• Channel Sales Manager -- Retail Supplier

• Business Development Manager

• Operations Manager/Director -- Retail Supplier -- Texas

|

|

|

|