|

|

|

|

|

ERCOT IMM Annual Report: With ORDC Changes, Net Revenues Exceed CONE For New Peaking Plants, Despite Capacity Surplus

The following story is brought free of charge to readers by VertexOne, the exclusive EDI provider of EnergyChoiceMatters.com

The ERCOT Independent Market Monitor filed its 2022 state of the market report which, among other things, concludes that net revenues now exceed the CONE range for new peaking resources (despite the prevailing capacity surplus)

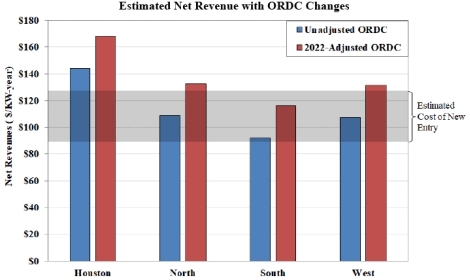

The IMM presented the chart below which the IMM said shows the existing profitability of combustion turbines with and without the Commission’s January 1, 2022, ORDC changes.

"In a typical market, one would expect that net revenues would fall as the planning reserve margin rises. However, net revenues in 2022 rose substantially as a result of the changes ERCOT implemented to the ORDC. These increases throughout ERCOT show how impactful the Commission’s revisions to the ORDC have been. With these changes, the net revenues in most zones would cover the costs of investing in new dispatchable resources, despite the prevailing capacity surplus," the IMM said

"Because net revenues now exceed the CONE range for new peaking resources (despite the prevailing capacity surplus), the IMM believes that the planned 'bridging solutions' are not necessary to provide efficient incentives to support investment in and retention of dispatchable resources," the IMM said

The IMM also addressed future reserve margins

The IMM noted that the May 2023 ERCOT CDR shows that planning reserve margins are projected to exceed 40%. "Much of this increase is driven by the sharp rise in solar capability beginning in 2024. The figure also shows a consistent reduction in existing supply from 2022 to 2027 as resources retire," the IMM noted

"We believe both of these effects are overstated in the CDR calculations. The contribution of solar to reliability is lower than shown in the CDR because of the correlated nature of its output which impacts the deliverability of the output. We also believe the projected retirements are overstated because of the market changes being implemented that should provide sufficient revenue to retain some or all of these resources. Taking these two offsetting items into account, we expect the planning reserve margin will likely be sustained near or above 30% in 2024 and beyond, but not as high as over 40%," the IMM said

Overall, the IMM said the ERCOT markets performed competitively in 2022 and the IMM found little evidence that suppliers exercised market power in the ERCOT market, with the following exception

The IMM said that the non-spinning reserve market became less competitive, as higher procurements caused large suppliers to frequently be pivotal. "We estimate that this raised the costs of non-spinning reserves from a range of $385 to $480 million from August 2021 through December 2022," the IMM said

The IMM noted that, as previously reported, the PUCT took actions to address this issue by modifying the Voluntary Mitigation Plans (VMPs) of large suppliers to recognize that mitigation is needed now in the non-spinning reserve market.

The IMM noted that, in some local areas, transmission system limitations on the amount of power that can flow into the area can increase opportunities to abuse market power. "However, mitigated offer price caps in these situations effectively addressed these opportunities in 2022," the IMM said

Transmission congestion in the real-time market -- incurred to dispatch generators to reduce flows over constrained lines -- was up 37% from 2021 to total $2.8 billion in 2022. More than $700 million was incurred during May related to Houston congestion, the IMM said

"ERCOT is increasingly limiting flows across certain network paths to maintain the stability of the system, which increases transmission congestion costs. These stability issues have partly resulted from the increase in inverter-based resources," the IMM said

The congestion associated with stability constraints increased from $400 million in 2021 to $640 million in 2022 -- representing roughly 20% of all real-time congestion.

The IMM remains concerned, "about insufficient incentives for suppliers to self-commit generation resources in light of ERCOT’s increased commitments through the Reliability Unit Commitment (RUC) process."

The IMM said that, during the second half of 2021 and also for 2022, "we noted that self-commitment of a particular large supplier lagged previous trends, and we concluded that this was likely due to ERCOT’s increased use of RUC and the incentives resulting from those actions."

The IMM noted that a market rule revision was proposed and passed by the ERCOT stakeholders to address this issue. The IMM proposes an additional change noted below

The IMM's report included the following new recommendations for market changes (in addition to again recommending various previously reported changes from the most recent prior report)

• Implement a multi-interval real-time market

• Institute 100% reliability unit commitment claw-back

• Allow transmission reconfigurations for economic benefits

• Change the linear ramp period for ERS summer deployments to 3 hours

• Change historical lookback period for ORDC mu and sigma calculations

With respect to implementing a multi-interval real-time market, the IMM said, "The real-time market relies primarily on two classes of resources: online resources and offline resources that can start quickly. The real-time market efficiently dispatches online resources and sets nodal prices that reflect the marginal value of energy at every location, but ERCOT lacks software and processes to facilitate efficient commitment and decommitment of peaking resources that can start quickly (i.e., within 30 minutes). This is a concern because suboptimal dispatch of these resources raises the overall costs of satisfying the system’s needs, can distort the real-time energy prices, and affects reliability. For these reasons, other markets have implemented this type of look-ahead process to optimize short-term commitments of peaking resources."

"Further, as ERCOT attracts more intermittent wind and solar resources, the value of having access to and optimally using fast-starting dispatchable resources will grow. Additionally, the rising amounts of fluctuations in intermittent output will increase the demands on other resources to ramp up and down. A multi-interval dispatch model can meet these increasing ramp requirements by recognizing the needs of the system further into the future and beginning to move dispatchable resources to optimally satisfy them. In contrast, the current market optimizes each dispatch interval independently."

"This is a recommendation that we made in years past. In 2017, ERCOT evaluated the potential benefits of a multi-interval real-time market and decided not to move forward because the costs were greater than the projected benefits. This finding was influenced by the level of surplus capacity on the system and the much lower level of renewable resources. Much has changed since that time -- we believe benefits will be much higher in the future and this capability will become essential for managing the growing renewable fleet. Hence, we recommend that it be reevaluated and prioritized for future implementation," the IMM said

With respect to instituting a 100% claw-back of excess market revenues for RUC units, the IMM said, "The incentives regarding self-commitment of resources have changed dramatically with the increased frequency of RUC instructions that occur now under ERCOT’s more conservative operations. Hence, previous market design decisions regarding RUC merit a fresh look; notably, we recommend rethinking RUC claw-back percentages. Currently, there are tiered claw-back percentages based on offers or awards in the day-ahead market. This design has been in place since the introduction of the nodal market and was a result of a desire to incent participation in the day-ahead market by generators. Such incentives are not needed because the day-ahead market provides revenue certainty and generally a risk premium to generators. In addition, there has proven to be robust participation and liquidity in the day-ahead market by all types of market participants."

"However, receiving full operational cost recovery via RUC make-whole while also getting the opportunity to keep half or all of any revenues above cost can undermine the incentive to self-commit generators even when they would likely be economic. For example, our analysis indicates that as much as 25% of the RUC-committed hours of combined-cycle and 30% of the RUC-committed hours of simple-cycle generators would have been economic," the IMM said

"Committing economic resources through the RUC process leads to artificial increases in ORDC revenues for the rest of a portfolio because of the RUC adjustment to online reserves, as well as additional revenues from the deployment price adder. We estimated the changes in these price adders that would have occurred if the RUC units economic to run had instead been self-committed. We found that the total energy revenue from the deployment price adder and the online ORDC adder would have fallen by $41 million and $839 million, respectfully. The latter reduction is 30% of all ORDC revenue. Hence, we recommend implementing a 100% claw-back for economic RUC units, which would discipline self-commitment decisions by generators that are likely to be economic and lower costs for ERCOT’s consumers," the IMM said

With respect to allowing transmission reconfigurations for economic benefits, the IMM said, "Currently, ERCOT’s approval processes only allow constraint management plans for reliability reasons. However, there are times in which a transmission reconfiguration can relieve congestion without negatively affecting reliability. Such plans should be developed and utilized. Both MISO and SPP are moving forward with this effort, though MISO is farther along."

"We recommend that ERCOT accept a limited number of proposals and independently identify options to reconfigure transmission elements in the network operations model when they are physically feasible and economically beneficial. A process can be established to identify which limited number of reconfiguration options have the biggest benefits," the IMM said

With respect to changing the linear ramp period for ERS summer deployments to 3 hours, the IMM said, "In all summer ERS deployments to date, including the deployment in 2022, resources returned to pre-instruction levels in approximately three hours. However, the current time value parameter for returning to the pre-instruction level in the reliability deployment price adder calculation (an output of the SCED pricing run) is 4.5 hours. This difference artificially inflates the reliability deployment price adder. We recommend that there instead be a separate summer value of 3 hours. A non-summer value of 4.5 hours can remain until such time as we have more ERS deployment data for non-summer months."

With respect to changing the lookback period for ORDC mean and standard deviation calculations, the IMM said, "The current ORDC statistical values of the mean and standard deviation used as inputs to the ORDC shape are based on historical data going back to the introduction of the nodal market. The

ORDC uses these historical values because the values are meant to be self-correcting as hour-ahead errors rise and fall over time. Because the resource mix has changed substantially in the last 12 years, the self-correcting nature of the ORDC is not able to capture the more recent data appropriately. Therefore, we recommend a rolling 5-year lookback period for the mean (mu) and standard deviation (sigma) parameters. Our analysis shows that this may reduce mu but raise sigma. The effect of this in 2022 would have been a savings of over $160 million. The importance of reducing the historical lookback period will increase over time and this change over the longer term is likely to raise revenues for suppliers in ERCOT."

Link to IMM report

ADVERTISEMENT ADVERTISEMENT Copyright 2010-23 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

May 30, 2023

Email This Story

Copyright 2010-23 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Sales Support Specialist

-- Retail Supplier

• Channel Sales Manager -- Retail Supplier

• Business Development Manager

• Operations Manager/Director -- Retail Supplier -- Texas

|

|

|

|