|

|

|

|

|

PUC Consultant's Report Recommends Elimination Of Non-Market-Based RTO Rider, Would Instead Allocate Costs To Customers' Retail Suppliers

The following story is brought free of charge to readers by VertexOne, the exclusive EDI provider of EnergyChoiceMatters.com

A report from a consultant retained by the Public Utilities Commission of Ohio has recommended the elimination of the current Non-Market-Based Services Rider (Rider NMB) at the FirstEnergy Ohio utilities, with the PJM costs currently recovered under the rider instead assigned to a customer's retail supplier

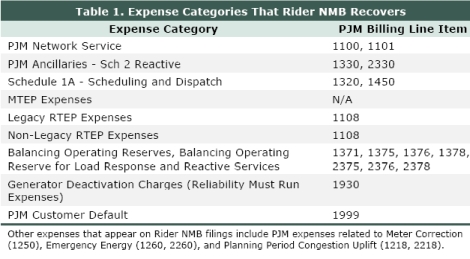

Rider NMB is nonbypassable, except for a limited amount of large customers under a pilot program who instead assume responsibility for the costs covered under Rider NMB via their retail supplier (or directly from PJM). Rider NMB recovers costs associated with, among other charges listed below, Network Integration Transmission Service

(NITS), Transmission Enhancement Charges (TEC), generation deactivation charges, and certain ancillary services. NITS and TEC account for approximately 90% and 5%, respectively, of total

Rider NMB costs.

Specifically, Rider NMB recovers the following costs:

As Rider NMB is nonbypassable, the utility assumes the obligation for costs covered under Rider NMB, and a customer's retail supplier is not assigned such costs from PJM, except for customers electing to opt-out of nonbypassable Rider NMB under the pilot program. Rider NMB costs are not reflected in default service rates.

The consultant recommends: "Eliminate Rider NMB for all customers. Assign

PJM transmission charges (and all other PJM billing line items

currently included in Rider NMB) to the retail suppliers of these

customers."

Regardless of whether PUCO adopts this recommendation, or the alternatives noted below, the consultant recommended, "Implement recommendations according to a

schedule, with an eye toward existing retail supply contracts, that

avoids financial harm to customers or to their SSO and CRES [competitive retail electric service] suppliers

to the maximum practical extent."

"Some customers may have entered into long-term fixed-price or pass-through

supply contracts with CRES suppliers based on the current regulatory

framework. Likewise, existing SSO supply contracts do factor the cost

components of Rider NMB in their pricing. Assigning additional PJM billing line

items to CRES or SSO suppliers without sufficient prior notice to all parties

can create confusion in the third-party supply market, invoke change-in-law

provisions for existing contracts, and lead to direct or indirect financial harm

to customers and suppliers. [The consultant] therefore recommends that the

Commission adopt a graduated implementation process for the above

changes. These changes may be best suited for adoption as part of a litigated

ESP process to give key stakeholders an opportunity to identify

implementation challenges," the consultant said

The consultant said that its analysis, "revealed that the customers receiving Pilot service, including

accounts served under small, medium, and large commercial rate schedules, attempt and attain reductions in NSPL and PLC when they are provided with

the opportunity and the incentive to do so."

"These load reductions also result

in decreases in costs, including shifting approximately $1.5 million a year in

transmission costs to non-FirstEnergy Ohio retail loads. These savings are

split between Pilot and non-Pilot customers, and exceed the estimated

administrative costs to operate the Program. Allowing additional customers to

internalize the benefits of their NSPL reductions can also enable them to

implement energy management practices that optimize their energy usage

timing, PLC reduction, and NSPL reduction efforts more holistically and make

more appropriate investments in their load management capabilities."

"Implementing across all customers, and not just customer-types currently

participating in the Pilot, helps avoid some of the multifaceted cost shifting

issues inherent to Rider NMB. Further, eliminating Rider NMB for all classes

addresses several administrative challenges involved in alternative, more

limited approaches, most especially procuring separate SSO products for

different customer classes based on their exposure to transmission costs, or

implementing special billing procedures to separate and assess transmission

costs for select SSO customers. These challenges already exist in a more

limited fashion under the Pilot. Finally, this approach also provides an

additional incentive for CRES providers and municipal aggregations to engage

with new market opportunities available once PJM implements FERC Order

2222, a decision requiring grid operators to open up their energy markets to

distributed resources including load response," the consultant said

"Despite the above benefits, [the consultant] also notes the absence of direct evidence in this particular

study that small FirstEnergy Ohio retail customers, particularly residential and lighting, do or

do not have the capability to engage with the types of incentives provided by the Pilot.

Additionally, it is unclear whether mass market customers can successfully enter into

contracts with retail suppliers that result in pass-through of benefits stemming from NSPL

reduction. Finally, [the consultant] did not evaluate supplier practices regarding hedging premium, and

cannot verify the presence or absence of a reasonable price premium from CRES providers or

wholesale SSO suppliers in the presence of PJM transmission charges. Thus, [the consultant] also offers

an alternative recommendation for the Commission’s consideration"

The consultant offers alternative recommendations as follows:

• Recommendation #2A: Eliminate Rider NMB for all medium

commercial, large commercial, and industrial customers. Assign PJM

transmission charges (and all other PJM billing line items currently

included in Rider NMB) to the retail suppliers of these customers.

• Recommendation #2B: Maintain Rider NMB for all residential,

lighting, and small commercial customers as a non-bypassable

charge.

• Recommendation #2C: Consider granting municipal aggregations the

option to bypass Rider NMB for residential, lighting, and small

commercial customers. Likewise, consider granting limited exceptions

for certain small accounts.

• Recommendation #2D: Modify Rider NMB to include only NITS, TEC,

and generation deactivation charges from PJM.

Concerning recommendation #2D, the consultant said, "NITS and TEC account for approximately 90% and 5%, respectively, of total

Rider NMB costs. In addition, NITS, TEC, and generation deactivation charges

are incurred at the PJM level as demand (NSPL)-based charges, while others

are incurred as energy-based charges. Rider NMB allocates all of these costs

to customer classes based on class demand allocators. Given the

misalignment between coast causation and cost allocation for all charges

other than NITS, TEC, and generation deactivation, and the fact that these

other charges are small, it would be administratively and economically more

efficient to assign these other costs to the retail suppliers of customers,

including both CRES and SSO providers. This recommendation is applicable to

any going-forward approach that does not involve eliminating Rider NMB in its

entirety by assigning all costs to CRES and SSO providers."

Addressing the costs and benefits under the pilot opt-out of nonbypassable Rider NMB, the consultant said, "the quantified benefits of the Pilot Program outweigh the costs. It is unclear whether

Rider NMB, however, results in overall cost savings to customers as compared to eliminating

Rider NMB and more directly exposing some or all customers to PJM transmission and ancillary

service costs. It does not appear that Rider NMB assigns costs or provides price signals

consistent with cost causation."

More specifically, the consultant said, "If the Pilot had not existed, the

Rider NMB revenue requirement for all customers would have been $231.1 million higher over

the 6-year recovery period of March 2017 – February 2023. Out of this difference in revenue,

$107.7 million are additional costs assigned to non-Pilot participants stemming from the

existence of the Pilot. That is, there is a $107.7 million cost shift paid by non-participants

over seven years. Non-participating large C&I customers absorb the greatest cost shift

(76.1%)."

The consultant further said, concerning a cost-benefit analysis, "the Pilot provided approximately $8.9 million in total benefit over the

7-year assessment period, or approximately $1.3 million per year."

"This summary does not reflect cost shifts, which are neither benefits nor costs. The potential

drivers of cost shifts are principally related to the structure of Rider NMB. These include

elements of temporal inconsistency, misaligned cost assignment, and incongruous customer

incentives. The existence of the Pilot reveals the shortcomings of Rider NMB in allocating

certain PJM costs to non-participating customers based on the principle of cost causation," the consultant said

Case 22-0391-EL-RDR

ADVERTISEMENT ADVERTISEMENT Copyright 2010-23 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

July 17, 2023

Email This Story

Copyright 2010-23 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Retail Energy Account Manager

|

|

|

|