|

|

|

|

|

Texas REP Asks: Why Are Certain Resources, Particularly Batteries, Offering Such High Prices

The following story is brought free of charge to readers by VertexOne, the exclusive EDI provider of EnergyChoiceMatters.com

Texas REP Rhythm Energy has released the following report below. EnergyChoiceMatters.com disclaims any responsibility for the content or data contained in the report. Any views expressed in the report may not necessarily reflect the view of EnergyChoiceMatters.com

Trends and learnings from summer 2023 wholesale electricity pricing in ERCOT

--- By Rhythm Energy

The Energy Reliability Council of Texas (ERCOT) operates an energy-only wholesale electricity market.

In this market, generators are paid primarily for the energy they supply to the grid. To incentivize the

development of future generating capacity, ERCOT employs scarcity pricing. This mechanism allows

for significant increases in the energy component of wholesale prices during periods of tight resource

availability. But what exactly is scarcity pricing? Scarcity pricing is an economic concept where prices

escalate as supply becomes constrained in a commodity market. As demand nears supply limits,

prices rise exponentially, highlighting the increasing scarcity.

Two primary drivers cause high wholesale prices:

1. Increasing Demand and Costly Generation: As demand rises, the grid often relies on less

efficient, subsequently more expensive, generation to accommodate the increased demand.

This elevation in generation costs, mirrored in generator offers, impacts the system-wide

wholesale price. ERCOT's economic dispatch algorithm evaluates these offers to optimize the

dispatch of online generation. This component is termed the Locational Marginal Price (LMP).

LMP enables electricity prices to reflect the value of electricity across various locations, taking

into account both generation costs and the physical constraints of the transmission system.

2. Administrative Pricing via ORDC: ERCOT employs an administrative pricing tool called the

Operating Reserve Demand Curve (ORDC). The ORDC ensures that electricity prices truly

signify supply shortage conditions. This mechanism, named RTORPA (Real-Time On-Line

Reserve Price Adder), is added to the LMP, resulting in the real-time wholesale electricity

price, known as the Settlement Point Price (SPP).

This summer, ERCOT faced sustained high temperatures leading to unprecedented demand.

Consequently, electricity prices were notably volatile, often skyrocketing to high levels while reserve

generation capacity looked healthy. This raises pertinent questions: What factors contributed to these

high prices? Were the pricing mechanisms effective? And how did they fare compared to previous

years?

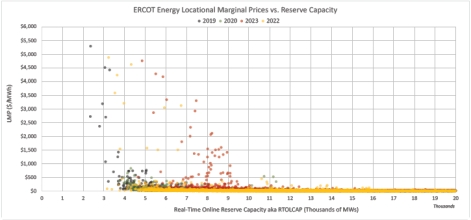

To address these questions, we dissected the real-time prices into their two major components: LMP

and RTORPA. We then juxtaposed them with the reserve generation capacity. Our analysis revealed

that the real-time LMPs were noticeably higher than in previous years at substantial reserve capacity

levels. For instance, LMPs often ranged between $500 to $3000/MWh at reserve capacities of

7000MW to 9000MW. This discrepancy is likely due to increased offer prices from generators. We

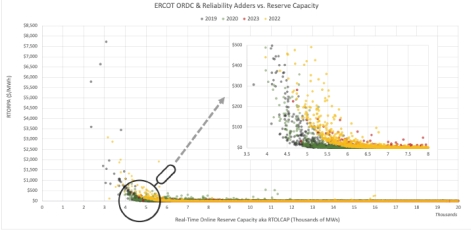

delve deeper into this phenomenon in our section on offer curves and SCED prices. The ORDC adder, RTORPA, was scarcely activated this summer, despite recent adjustments to the

ORDC curve. This can be attributed to the infrequent dips in reserve capacity to the shortage range.

Moreover, since the cumulative LMP and adders cannot surpass the system-wide offer cap of

$5000/MWh, on occasions where reserves fell into the shortage pricing range, because LMPs already

approach the $4500 to $5000/MWh range, the ORDC adder could not exceed $500/MWh.

A burning question arises: Why were LMPs so high compared to previous years at relatively healthy

reserve capacity levels? A significant factor is the offer curves from generators.

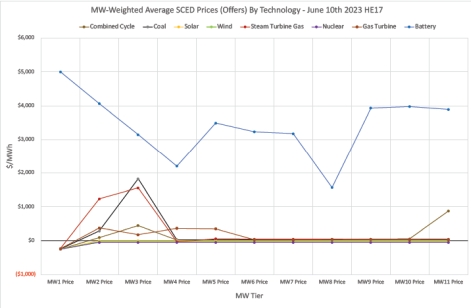

Our data indicates that an escalating fraction of generation resources, predominantly battery storage,

are offering prices close to or at the cap. This contributes to surging LMPs, even when ORDC adders

are dormant. In essence, these offer curves seem to induce artificial shortage pricing, reflected

through elevated LMPs rather than ORDC adders, at reserve capacities between 6000MW to

9000MW. In other words most of the recent dispatchable capacity added to ERCOT to meet the load

growth seems to be priced for emergencies rather than economically. This trend has repercussions.

Elevated prices eventually trickle down to consumers, signaling potential price hikes if this pattern

persists.

A crucial query remains: Why are certain resources, particularly batteries, offering such high prices?

Several factors could be influencing this, including:

• Operational challenges in integrating and dispatching batteries.

• Market design elements that require tweaks to enable more appropriate bidding

• Physical limitations of the current batteries on the grid.

• Regulatory challenges or potential loopholes influencing offer behaviors.

Conclusively, ERCOT, PUCT, and stakeholders are tirelessly analyzing data and implementing

refinements to facilitate the intricate journey of energy transition.

ADVERTISEMENT ADVERTISEMENT Copyright 2010-23 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Lists, "Potential Loopholes Influencing Offer Behaviors", As One Possible Reason

August 21, 2023

Email This Story

Copyright 2010-23 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Call Center Manager -- Retail Supplier

• NEW! -- Senior Billing Subject Matter - (Remote) -- Retail Supplier

|

|

|

|