|

|

|

|

|

Texas PUC Staff Draft Proposal For Publication Would Require $1.5 Million Letter Of Credit For Mid-Size Retail Electric Providers (Applicable To Existing REPs)

The following story is brought free of charge to readers by EC Infosystems, the exclusive EDI provider of EnergyChoiceMatters.com

Staff of the Texas PUC have filed a recommended (draft) proposal for publication to modify the retail electric provider certification rules

The draft proposal for publication follows an earlier discussion draft (see background here)

The Staff proposal provides that a person already certified as an Option 1 REP would be required to come into compliance with the modified rules by August 15, 2023.

Notably, Staff's draft would modify that financial requirement for Option 1 REPs under both 16 TAC § 25.107(f)(1)(A) and § 25.107(f)(1)(B)

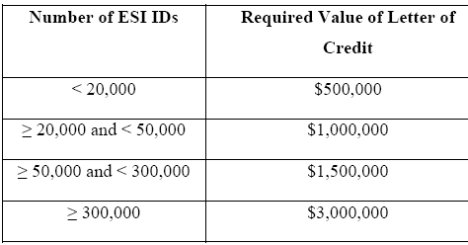

With respect to § 25.107(f)(1)(B), the rules governing a REP which uses a letter of credit to show the requisite access to capital, Staff's proposal provides for varying levels for the letter of credit, based on REP size

Specifically, the Staff draft provides that a REP may maintain an irrevocable stand-by letter of credit with a face value based on the number of electronic service identifiers (ESI IDs) the REP serves.

The proposed required letter of credit for § 25.107(f)(1)(B) REPs would be as shown in the chart below

For comparison, the current rules provide that the level of the stand-by letter of credit for access to capital is a flat $500,000

As the number of ESI IDs served by the REP increases, the irrevocable stand-by letter of credit must be adjusted to reflect the required value shown above, the draft provides. As the number of ESI IDs served by the REP decreases, the irrevocable stand-by letter of credit may be adjusted to reflect the required value

Additionally, for the first 24 months that a § 25.107(f)(1)(B) REP is serving load, it must maintain not less than one million dollars in shareholders’ equity, Staff proposes

Additionally for § 25.107(f)(1)(B) REPs, for the first 24 months that a REP is serving load, a REP must not make any distribution or other payment to any shareholders, affiliates, or corporate parent’s affiliates if, after giving effect to the distribution or other payment, the REP’s shareholders’ equity is less than one million dollars. Distributions or other payments include, but are not

limited to, dividend distributions, redemptions and repurchases of equity securities, and loans to shareholders or affiliates, the draft states. After a REP has continuously served load for 24 months, a prescribed amount of maintained shareholders’ equity is no longer required.

For REPs electing to meet the access to capital requirement via a standard form irrevocable guaranty agreement [§ 25.107(f)(1)(A)], Staff's proposal provides as follows:

(A) A REP may maintain an executed version of the commission approved standard form irrevocable guaranty agreement.

(i) The guarantor must be:

(I) One or more affiliates of the REP;

(II) A financial institution with an investment-grade credit rating; or

(III) A provider of wholesale power supply for the REP, or one 25 of such power provider’s affiliates, with whom the REP has executed a power purchase agreement.

(ii) The guarantor must have:

(I) An investment-grade credit rating; or

(II) Tangible net worth greater than or equal to $100 million, a minimum current ratio (defined as current assets divided

current liabilities) of 1.0, and a debt to total capitalization ratio not greater than 0.60, where all calculations exclude unrealized gains and losses resulting from valuing to market the power contracts and financial instruments used as supply hedges to serve load.

The guarantor’s obligation to satisfy the commission’s demand for payment must be in an amount not less than $1,500,000 and must be absolute, and the guarantor may not avoid its obligation for any reason, Staff's draft provides

Separate from the access to capital requirements noted above, a REP must maintain customer deposits in an escrow account, segregated cash account, or provide an irrevocable stand-by letter of credit. A REP must maintain customer prepayments in an escrow account or provide an irrevocable stand-by letter of credit, Staff's draft provides

Notably, for customer prepayments, Staff's draft provides that a REP must maintain, at minimum, protection for all customer prepayments that equals or exceeds $50. The balance of an escrow account or an irrevocable stand-by letter of credit must be adjusted, as necessary, to maintain a minimum of 100% coverage of customer prepayment funds equal to or exceeding $50 held at the close of each calendar month.

Turning to REP principals and managerial requirements, the Staff proposal generally expands the current prohibition, on principals from REPs which experienced a POLR drop from controlling a REP, to include similar defaults, and also expands the prohibition to those who served at a defaulting REP immediately prior to the default (but who may not have been serving at the REP at the time of default)

Under the draft, in no instance may any of the following persons control the REP or be relied upon to meet the managerial and technical requirements of the rule:

(A) a person who was a principal of a REP that experienced a POLR mass transition of the REP’s customers at any time within the six months prior to the mass transition;

(B) a person who was a principal of, at any time within the prior six months, a market participant whose ERCOT SFA or similar agreement for an independent organization other than ERCOT was terminated;

(C) a person who was a principal of, at any time within the prior six months, a market participant that exited an electricity or gas market with outstanding payment obligations that remain outstanding; or

(D) a person who, by commission order, is prohibited from serving as a principal for any commission-regulated entity.

Consistent with this new concern, REPs would also be required in their applications all of the applicant’s principals, executive officers, employees, third-party providers, and third-party provider’s employees that:

(a) exercised direct or indirect control over a REP that experienced a POLR mass transition at any time within the six months prior to the mass transition

(b) exercised direct or indirect control at any time within the six months prior to a market participant having had its ERCOT SFA terminated or a similar agreement for an applicable independent organization terminated

(c) exercised direct or indirect control within the prior six months of a market participant having exited an electricity or gas market with outstanding payment obligations that remain outstanding

Also with respect to managerial requirements, the Staff proposal makes explicit that the current requirement, that a REP have one or more executive officers or employees in managerial positions whose combined experience in the competitive electric industry or competitive gas industry equals or exceeds 15 years, cannot be met through use of a third-party provider

Staff's draft proposal for publication includes a significant modification from the discussion draft with respect to the suspension of a REP's ability to enroll new customers in case of bankruptcy or other circumstances.

As exclusively first reported by EnergyChoiceMatters.com, the discussion draft would have allowed PUC Staff to direct ERCOT to suspend a REP's ability to enroll customers if the REP was engaged in bankruptcy proceedings, if the REP had entered into a payment plan with ERCOT, or if Staff deemed the REP out of compliance with the financial and managerial rules or other certification rules.

In contrast, the Staff draft proposal for publication would provide that the Commission or presiding officer may suspend a REP’s ability to acquire new customers upon a showing of facts that reasonably support the occurrence of a significant violation of PURA, commission substantive rules, or protocols adopted by the applicable independent organization (ERCOT). A suspension of a REP’s ability to acquire new customers may be limited to specific customer classes. The commission may also impose administrative penalties and other conditions on a REP whose ability to acquire new customers has been suspended, the draft provides

Staff's draft includes a new definition for "control" which is: "The term control (including the terms controlling, controlled by and under common control with) means the direct or indirect possession of binding authority to direct or cause the direction of the management, policies, operations, or decision-making of a person, whether through ownership of voting securities, by contract, formation documents, or otherwise. A principal is a controlling person. A third-party provider may be a controlling person."

Staff's draft would alter the requirement for Option 2 REPs to include a customer affidavit with their application, allowing such REPs to file such customer affidavit within 30 days of application approval

For Option 2 REPs, if the REP does not file an affidavit from a customer with which it has contracted to provide one megawatt or more of energy by the 30th day of the application being approved, then the presiding officer will administratively revoke the REP certificate without prejudice.

The draft would require that REPs must respond within five working days to any Commission staff request for information (this had been proposed to be 3 working days in the discussion draft)

The draft would revise the time by which REPs must respond to various types of complaints from 21 days to 15 days

Project 52796

ADVERTISEMENT ADVERTISEMENT Copyright 2010-22 Energy Choice Matters. If you wish to share this story, please

email or post the website link; unauthorized copying, retransmission, or republication

prohibited.

Draft Includes Changes To Financial, Technical Requirements For REP Certification

Proposed Enrollment Suspension For Bankrupt REPs Addressed

September 27, 2022

Email This Story

Copyright 2010-21 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

NEW Jobs on RetailEnergyJobs.com:

• NEW! -- Operations Manager - Retail Supplier

• NEW! -- Marketing Associate - Retail Supplier

• NEW! -- Supervisor-Commercial Operations

• NEW! -- Customer Data Specialist

• NEW! -- Director, Regulatory Affairs, Retail Supplier

• NEW! -- Account Manager Project Manager

• NEW! -- Retail Energy Policy Analyst

• NEW! -- Incentive Specialists

• NEW! -- Utility Rates Specialist

• NEW! -- Customer Onboarding Specialist

• NEW! -- Energy Performance Engineer

• Controller for C&I-only Retail Electricity Supplier

• Senior Retail Transportation Analyst (Gas Transport Services)

|

|

|

|