|

|

|

|

|

NRG Energy To Acquire 13 GW Of Generation From LS Power, Will Also Acquire CPower & 6 GW VPP Portfolio

The following story is brought free of charge to readers by VertexOne, the exclusive EDI provider of EnergyChoiceMatters.com

NRG Energy Inc. and LS Power Equity Advisors, LLC today announced that they have entered into a definitive agreement under which NRG will acquire a portfolio of natural gas generation facilities and a commercial and industrial virtual power plant (C&I VPP) platform from LS Power in a cash and common stock transaction valued at approximately $12.0 billion Enterprise Value, which the companies said represent an acquisition multiple of 7.5x 2026 EV/EBITDA, or what the companies said is 50% of estimated new build replacement cost.

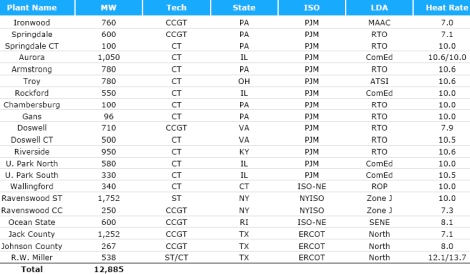

This acquisition doubles NRG’s generation capacity with the addition of 18 natural gas-fired facilities totaling approximately 13 GW. These facilities, located across nine states, expand NRG’s generation footprint in the Northeast and Texas, where most of its load is located. The specific assets to be acquired from LS Power are listed below

The acquisition also shifts NRG's supply mix to long-owned generation versus residential load, NRG said

Specifically, in the Northeast, the acquisition will add about 9 GW of capacity to NRG, where NRG's residential peak load is 4 GW and NRG's current capacity is 2 GW

In Texas, after the acquisition, NRG will generate about 82 TWh, versus residential load of 40 TWh. The 82 TWh include 33 TWh of current NRG in-the-money generation, an added 9 TWh from LS Power, and 40 TWh of out-of-the money generation

In a presentation, NRG said of the acquired generation: "Scaled fleet expands capabilities to serve rapidly growing

customer demand for tailored supply solution, enhances

risk management, and lowers costs-to-serve, particularly

for long-term PPAs".

In addition, NRG is acquiring CPower, a C&I VPP platform which has approximately 6 GW of capacity representing more than 2,000 commercial and industrial customers.

The VPP acquisition brings NRG's VPP platform to 8 GW

The 6 GW CPower VPP portfolio includes the following VPP capacity by market (only select markets listed):

"This acquisition transforms NRG’s generation fleet and broadens our customized product offerings, enhancing our ability to bring the future of energy to millions of customers across the U.S.," said Larry Coben, NRG Chair, President & Chief Executive Officer.

NRG said, "The acquisition expands NRG’s capabilities to serve rapidly growing demand for tailored, long-term supply solutions for customers -- particularly data centers. It also enhances NRG’s additionality offerings through 1+ GW of potential uprates, additional sites for potential development or colocation opportunities, and a differentiated C&I VPP platform."

NRG said, "The transaction Enterprise Value of approximately $12.0 billion is comprised of $6.4 billion of cash consideration, $2.8 billion in stock consideration to LS Power (24.25 million shares of NRG stock using the 10-day trailing VWAP of $114.98), $3.2 billion of net debt assumed at closing, less approximately $0.4 billion of the NPV of tax benefits generated directly as a result of the transaction. The transaction is not expected to trigger any change of control provisions under such assumed debt."

NRG said, "LS Power is expected to own approximately 11% of the pro forma NRG shares outstanding and has committed to a 6-month lock-up period with respect to its equity ownership of NRG common stock. LS Power’s election to receive NRG shares for approximately 23% of the purchase price, which is equivalent to 30% of its net consideration after debt assumption, reflects a strong conviction in NRG’s post-acquisition value. A portion of LS Power’s shares will be held in a voting trust such that it will control less than 10% of the overall voting rights of NRG stock at all times."

The acquisition is expected to close in the first quarter of 2026, subject to customary closing conditions and regulatory approvals including Hart-Scott-Rodino (HSR), Federal Energy Regulatory Commission (FERC), and the New York State Public Service Commission (NYSPSC).

NRG announced the acquisition from LS Power as NRG reported first quarter earnings

NRG said that NRG's retail energy business, "continued to deliver strong margins."

NRG reported Adjusted EBITDA for Q1 2025 of $1,126 million, up from $870 million a year ago

In the Texas segment, first quarter 2025 Adjusted EBITDA was $299 million, $80 million higher than the prior-year period. "The increase is primarily driven by higher economic gross margin, including impact of weather, strong plant performance, and supply optimization," NRG said

In the East segment, first quarter 2025 Adjusted EBITDA was $474 million, $123 million higher than the prior-year period. "This increase is primarily driven by higher natural gas wholesale and retail gross margins and increased volumes from weather, and higher generation volumes and capacity prices in New York, partially offset by an increase in planned outage expenditures as compared to prior year," NRG said

NRG also reported that on April 10, 2025, NRG closed on the strategic acquisition of a 738 MW natural gas combined cycle peaking generation portfolio in Texas from Rockland Capital for $560 million subject to standard working capital adjustment, or what NRG said was an "attractive" $760 per kW, which NRG said is, "far below the cost of a new build."

The assets to be acquired from LS Power are below:

Copyright 2025 EnergyChoiceMatters.com. Unauthorized copying, retransmission, or republication

prohibited. You are not permitted to copy any work or text of EnergyChoiceMatters.com without the separate and express written consent of EnergyChoiceMatters.com

May 12, 2025

Email This Story

Copyright 2025 EnergyChoiceMatters.com

Reporting by Paul Ring • ring@energychoicematters.com

ERCOT 0.5 GW

PJM 3.9 GW

NYISO 0.5 GW

ISO-NE 0.7 GW

|

|

|

|

|